4 Top Rated Stocks for Traders

For short-term traders of stocks, there are few better candidates to choose from than those with Short Term PowerRatings of 9 or 10. In rising markets and falling markets, stocks with the higher PowerRatings have outperformed the average stock by more than 13 to 1.

Stocks with the absolute highest PowerRatings have actually outperformed the average stock over the next five days by nearly 17 to 1.

Our Short Term PowerRatings incorporate a number of key factors that underlie stock price movement. We factor in momentum, volume, trend and volatility to create a rating system that can give short term traders great confidence that the stocks they select to trade are likely to be among the better performing stocks in a week’s time.

Whether you use our Short Term PowerRatings as a final screen after your own trading system has produced a list of trading candidates, or simply use one of our trading setups to place a limit order below the close of a high PowerRating stock and wait for that stock to “come in,” our Short Term PowerRatings are a boon for traders looking to enter and exit a trade within the short term trader’s “sweet spot”

from 5-8 days.

In addition to having Short Term PowerRatings of 9, all four stocks in today’s discussion are trading above their 200-day moving averages. When the broader markets are healthy and strong, trading above their 200-day moving averages, it is less important for stock traders to make sure that the stocks they buy to also be above their 200-day moving averages. In other words, when the markets are strong, stocks can be given the benefit of the doubt in the short-term.

However when markets are struggling below their 200-day moving averages-as the Dow industrials, S&P 500 and Nasdaq all have been doing for the past few months, traders need to “shorten up their stroke” by limiting their buys-even their short-term buys-to stocks that are above their 200-day moving averages.

As Larry Connors explained in a much-read and widely-circulated primer late last year, “5 Mistakes to Avoid in a Market Trading Below its 200-day Moving Average”, when markets are under pressure it is too risky to try and buy stocks that are also under pressure. This is all the more unnecessary when there are (a) plenty of stocks that are likely overbought and shortable and (b) plenty of stocks that are trading above their 200-day moving averages, but are experiencing pullbacks and corrections that are actually making them less expensive.

Click here to read Larry Connor’s article, “5 Mistakes to Avoid in a Market Trading Below its 200-day Moving Average.”

As I mentioned, all four of today’s top rated stocks have PowerRatings of 9-putting them in that category of stocks that have outperformed the average stock by more than 13 to 1 after five days. And, as I also mentioned, all four are trading above their 200-day moving averages, representing the sort of relatively strong and healthy stock that traders can still buy in the short term when the broader markets are struggling.

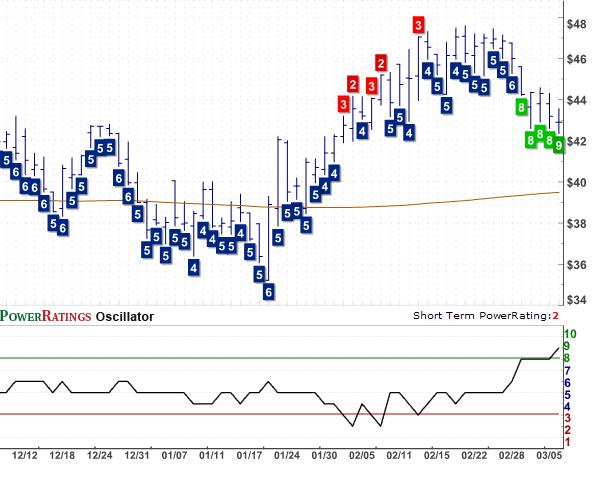

Tompkins Financial Corporation

(

TMP |

Quote |

Chart |

News |

PowerRating)

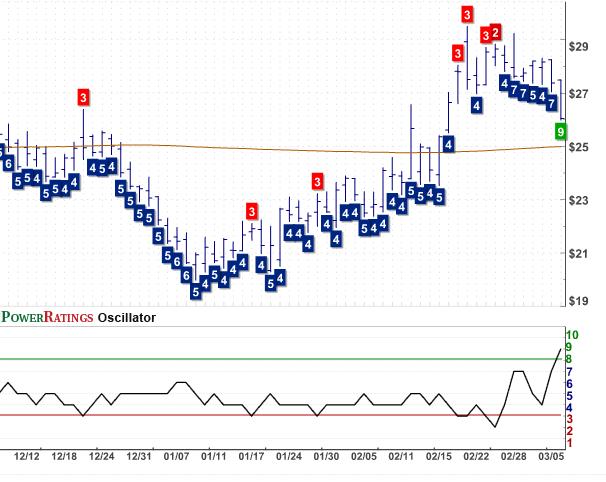

JAKKS Pacific Inc.

(

JAKK |

Quote |

Chart |

News |

PowerRating)

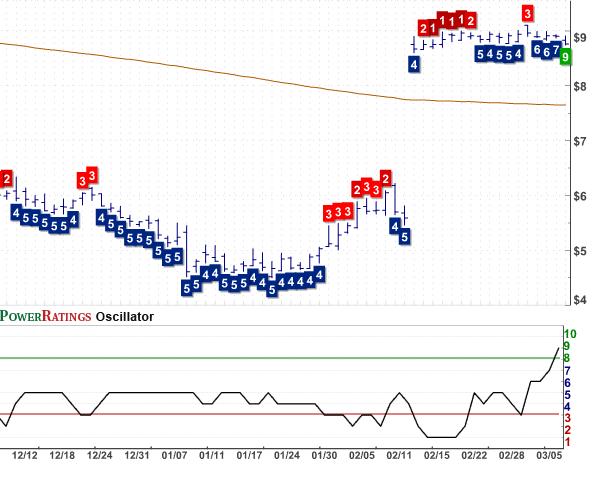

GMH Communities Trust

(

GCT |

Quote |

Chart |

News |

PowerRating)

eResearch Technology Inc.

(

ERES |

Quote |

Chart |

News |

PowerRating)

David Penn is Senior Editor at TradingMarkets.com.