5 High Powered ETFs for Traders

We promised you more about trading opportunities in exchange-traded funds. And thanks to recent market strength, we have five ETFs that are both leveraged and inversely structured to let traders buy in order to take advantage of markets moving down.

Generally when traders want to bet against a market, they short sell a stock. More recently, with the explosion in exchange-traded funds, traders have been able to sell short ETFs that represent sectors of the economy or specific industry groups, as well as investing styles like growth or value and market indices such as the Dow industrials, the Nasdaq or the Russell 2000.

But the innovation that has characterized the market for exchange-traded funds has continued, with the proliferation of exchange-traded funds that are also both leveraged and inversely related to their underlying market. It is no exaggeration to say that these new ETFs have opened up an entirely new universe for traders looking to take advantage of short-term price fluctuations in a wide variety of markets.

First, let’s talk about leverage. One of the sore spots for traders looking to trade exchange-traded funds is that because they are funds, they tend to have less volatility than the average stock. Unfortunately, because volatility is the wind behind the sails of stocks in the short term, the fact that ETFs tend to be less volatile makes them less attractive candidates for short-term trades, all things considered.

Leveraged ETFs that allow traders to double or even quadruple their returns (if margin is used) are one solution to this problem for short-term traders. By, essentially, doubling the “bang for the buck” traders can use a leveraged exchange-traded fund in the same way they would use an ordinary, non-leveraged exchange-traded fund–same method or technical set-up–yet because of the leverage, receive significantly higher returns for every correct trade.

The other innovation that should be mentioned here is the idea of the inverse ETF. Inverse mutual funds had been around for some time before inverse ETFs hit the market, and in the same way that exchange-traded funds have become more popular among traders than mutual funds, inverse ETFs are increasingly a more popular way for traders to bet against the market than by using the more cumbersome inverse mutual funds for the same purpose.

An inverse exchange-traded fund simply seeks to match the performance of a given index, or industry group or investment style–but in an inverse fashion. So if the Dow industrials were down 2%, an inverse exchange-traded fund based on the Dow industrials should be up approximately 2%. One of the things that make these inverse ETFs so attractive is that they allow traders to buy (rather than short sell) an asset in order to bet against the underlying asset. There’s no need to borrow shares or worry about short squeezes or any of the other issues that typically preoccupy traders when they sell stocks (or ETFs) short.

When you combine both leveraged and inverse qualities into an exchange-traded fund, what you get is a set of some of the most popular and increasingly widely-traded ETFs on the market. For the first time, average retail traders have the ability to make leveraged bets against a market without having to go on margin and without having to sell stocks–or exchange-traded funds–short. These innovations are a true boon for short-term traders of all types, whether they are pullback players or breakdown/breakout specialists, traders to the long and short sides or simply traders who prefer to remain long only. It should also go without saying that leveraged, inverse and leveraged-inverse exchange-traded funds open up a wealth of hedging strategies for traders looking to protect their positions against market risk.

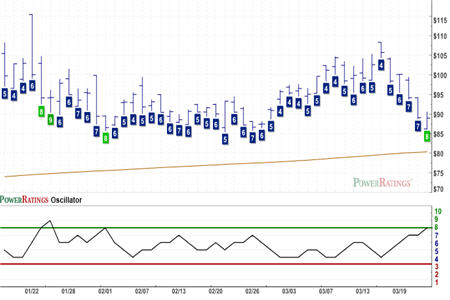

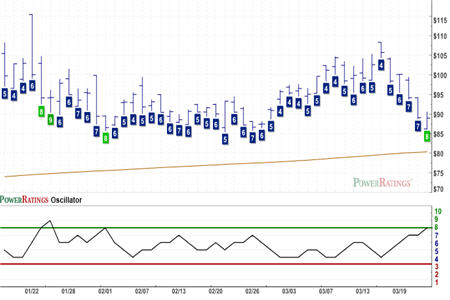

All of the exchange-traded funds in today’s report have Short Term PowerRatings of 8. According to our research, that means that these five stocks belong to that class of stocks that has outperformed the average stock by more than 8 to 1 over the next five days. Also listed below are the 2-period Relative Strength Index (RSI) values for each fund, so that traders can see just how oversold some of these ETFs truly are.

ProShares UltraShort Russell 2000 Growth Fund

(

SKK |

Quote |

Chart |

News |

PowerRating). RSI(2): 9.54

ProShares UltraShort Financials

(

SKF |

Quote |

Chart |

News |

PowerRating). RSI(2): 14.25

ProShares UltraShort Russell 2000 Value Fund

(

SJH |

Quote |

Chart |

News |

PowerRating). RSI(2): 11.15

ProShares UltraShort Consumer Services

(

SCC |

Quote |

Chart |

News |

PowerRating). RSI(2): 7.56

ProShares UltraShort QQQ Fund

(

QID |

Quote |

Chart |

News |

PowerRating). RSI(2): 11.66

There are five things that every successful short term stock trader knows about trading markets like these. We have published all five in a new, special report called “5 Secrets to Short Term Stock Trading Success” now available for free. Learn what key factors are involved in turning mediocre speculators into professional-grade, short-term stock traders–and how our Short Term PowerRatings can play a part. Click here for your free report–or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.