5 PowerRatings Upgrades for Traders

Each day at TradingMarkets we alert traders to the biggest

one-day upgrades in their Short Term PowerRatings. Here, we want to focus on the stocks with not only the biggest one-day upgrades, but also the highest PowerRatings. These are the stocks our research has indicated are likely to outperform the average stock over the next five days.

Our Short Term PowerRatings are based on a number of key factors that help determine whether a stock is likely to move higher or lower in the near-term. Measuring aspects of trend, momentum, volatility and volume, our Short Term PowerRatings provide traders with an edge both in terms of helping spot the right stocks to trade at the right time, as well as a filter for traders using other trading systems to produce buy and sell candidates.

Just about any trading strategy–from buying pullbacks to buying breakouts–can be improved by using our Short Term PowerRatings as a filter. Once your trading system or method has generated a list of stocks for potential trades, simply run the list through our Short Term PowerRatings and trade only the stocks that have high PowerRatings of at least 8–if not 9 or 10.

Why? Our research has revealed that stocks with Short Term PowerRatings of 8 or more have outperformed the average stock by more than 8 to 1 over the next five days. When combined with a sound trading strategy, high PowerRating stocks can help deliver outstanding returns for short term traders, helping them stick to stocks that, based on our research, are more likely to do well than the average stock that might be suggested by a trading system as a worthwhile candidate for trading.

Our PowerRatings Upgrades let traders know which stocks have experienced increases in their attractiveness as trades, with an emphasis on the biggest one-day changes. This can help alert traders to opportunities in stocks as soon as they appear. When a stock, for example, has a dramatic PowerRating upgrade from, say, 5 to 9, we have a stock that goes from an average expected performance to a stock that, based on our examination of millions of simulated trades since 1995, is likely to outperform the average stock by more than 13 to 1.

Stocks with Short Term PowerRatings have performed even better, outdoing the average stock by nearly 17 to 1 after five days.

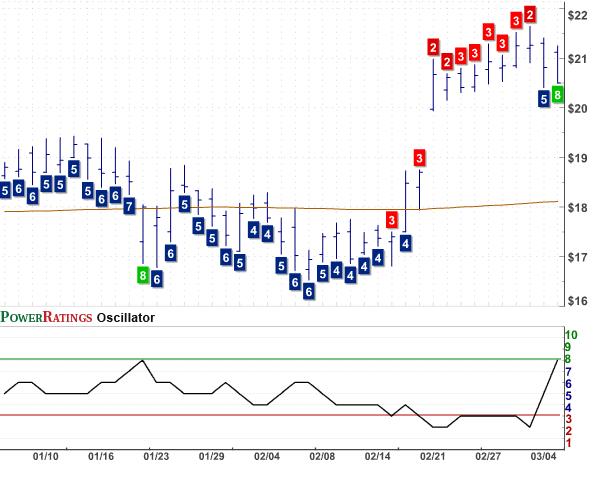

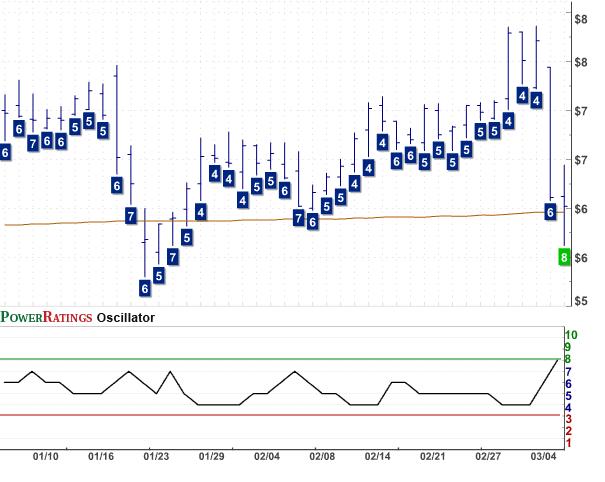

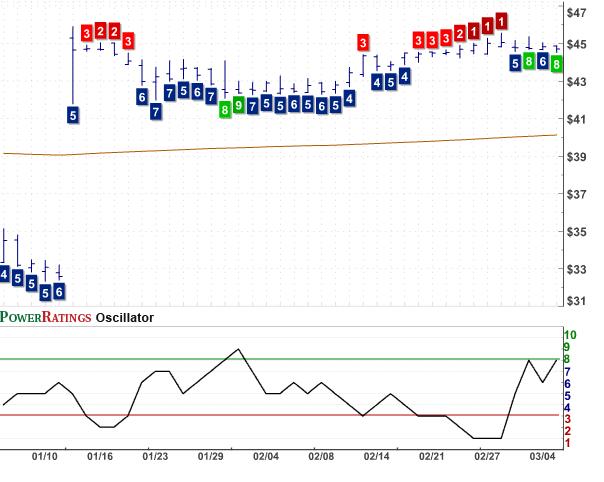

All five of the stocks in today’s discussion have Short Term PowerRatings of 8 which, as noted above, make them likely to outperform the average stock over the next five days. Each stock is accompanied by a PowerRating chart which lets traders visually see the pullbacks the stocks are experiencing, as well as the proximity of support and resistance.

NetEase.com

(

NTES |

Quote |

Chart |

News |

PowerRating)

Valence Technology

(

VLNC |

Quote |

Chart |

News |

PowerRating)

North American Palladium

(

PAL |

Quote |

Chart |

News |

PowerRating)

Brigham Exploration

(

BEXP |

Quote |

Chart |

News |

PowerRating)

Bright Horizons Family Solutions

(

BFAM |

Quote |

Chart |

News |

PowerRating)

David Penn is Senior Editor at TradingMarkets.com.