6 More Oversold Stocks for Traders:

Yesterday we began introducing a few oversold names that short-term traders looking for pullbacks to buy should begin considering. Given the way the market closed yesterday, rallying from its intraday lows, it looks like there are even more oversold opportunities for traders to choose from today.

The current set of six stocks under discussion today have in common one of our key Stock Indicators, an indicator that has helped us spot stocks that will be higher in one-day, two-day and one-week timeframes.

All six stocks have experienced five or more consecutive down days. While we cannot imagine a trader holding any one of these stocks feeling any more bearish than they would have five or more days in a row of selling, selling and more selling, our research into short-term stock behavior going back to 1995 reveals that, the more days in a row a market retreats, the more likely it is to eventually outperform its peers.

There are caveats, of course. The most important caveat is that the stock itself be a strong stock, a stock that is trading above its 200-day moving average. We have found the 200-day moving average to be an effective filter to separate the stocks that have an upward bias with the stocks that have a downward bias.

So it is those strong stocks that are trading above the 200-day moving average that have experienced five or more consecutive down days that make our TradingMarkets Stock Indicators listing. These are the sort of stocks that short-term traders should be targeting in the current market environment.

Click here to read our research into consecutive down days.

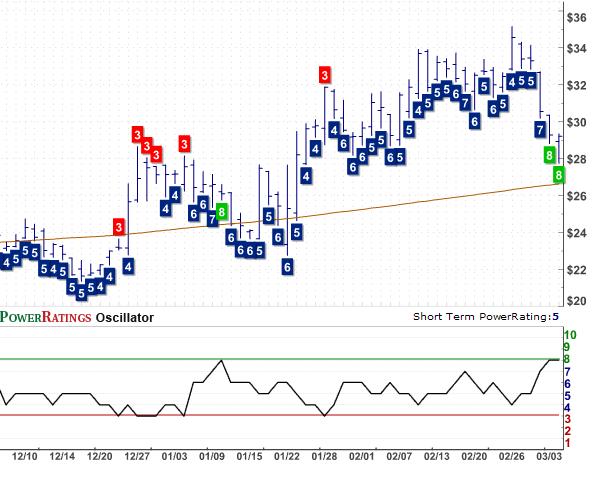

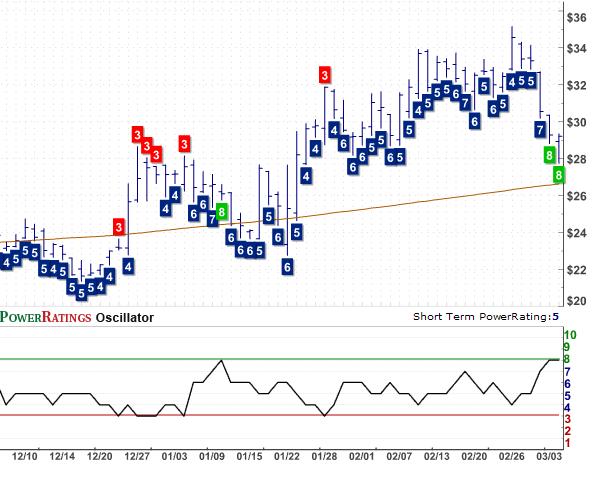

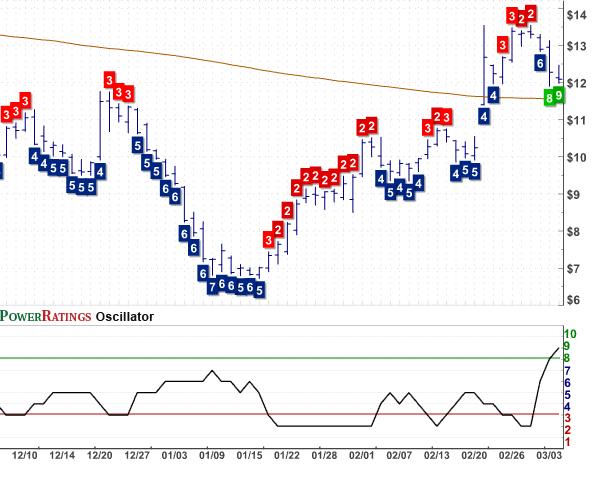

PowerRating charts can be invaluable in understanding how Short Term PowerRatings work and how these opportunities are setting up. Consider first Cree Incorporated

(

CREE |

Quote |

Chart |

News |

PowerRating) , with its Short Term PowerRating of 8.

The last time CREE had a PowerRating of 8 was in the first half of January. The stock showed a few additional days of weakness, making it possible for traders buying pullbacks to get an even lower price as the stock tested its 200-day moving average. Finding a low near $23, the stock bottomed and within eight days of earning its 8 PowerRating the stock was moving dramatically higher. By late February, CREE has moved into the low $30s

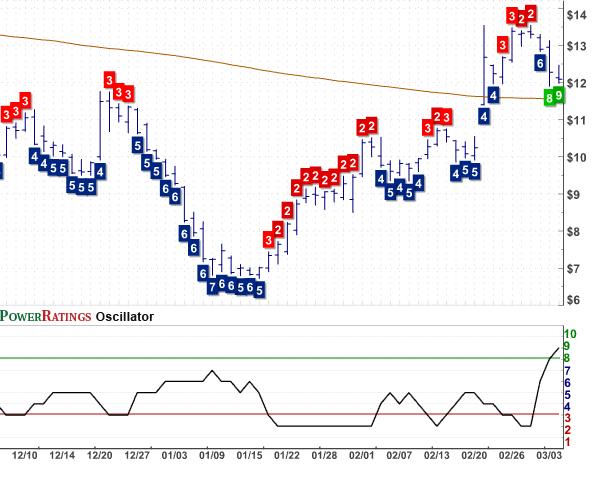

Another interesting example of Short Term PowerRatings at work in these oversold stocks comes from the chart of Furniture Brands

(

FBN |

Quote |

Chart |

News |

PowerRating). Here, we have a stock that had been trading below its 200-day moving average for most of the past few months. The stock’s PowerRating of 9 occurred just as the stock broke out above its 200-day moving average and fell back to test that level for support. As we saw with CREE, stocks testing their 200-day moving average support can be powerful gainers in a relatively short period of time when that test proves successful.

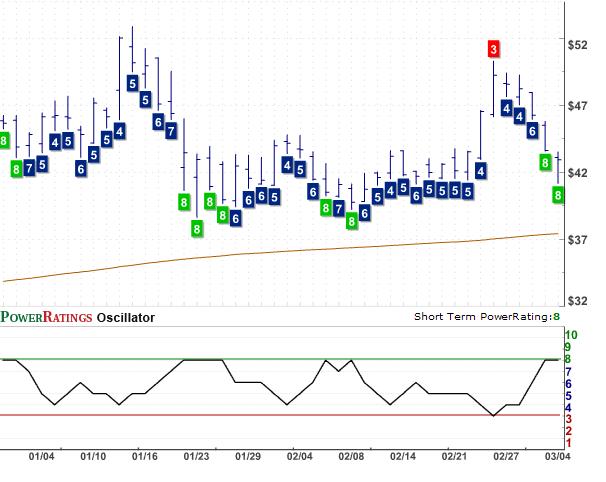

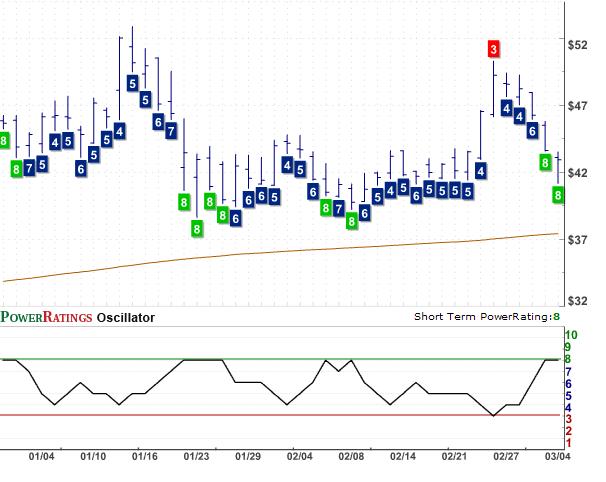

One last example with charts before listing the remaining stocks in today’s discussion. FC Stone Group

(

FCSX |

Quote |

Chart |

News |

PowerRating) has an exceptionally low PowerRating as recently as a week ago as a dramatic spike higher in the shares helped drive the stock’s rating down from a 4 to a 3. This PowerRatings downgrade was timely, as the stock immediately reversed and began moving lower, falling from just under $52 to just under $42 in a matter of days.

It is this pullback to support at its 200-day moving average that has helped upgrade FCSX’s PowerRating in a very short period of time from the 4 rating the stock had at its peak to the PowerRating of 8 it currently has.

Here is a complete listing of today’s six oversold stocks for traders, including the three featured in the charts above. I have also noted the 2-period Relative Strength Index values for all six stocks to help traders get a better sense of how oversold the various names are.

Cree

(

CREE |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 4.81

Furniture Brands

(

FBN |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 9. RSI(2) 5.98

FC Stone Group

(

FCSX |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 5.28

Universal Display

(

PANL |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 5.54

Questcor Pharmaceuticals

(

QSC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 2.79

Exploration Company of Delaware

(

TXCO |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 2.58

David Penn is Senior Editor at TradingMarkets.com.

(

CREE |

Quote |

Chart |

News |

PowerRating) , with its Short Term PowerRating of 8.

(

FBN |

Quote |

Chart |

News |

PowerRating). Here, we have a stock that had been trading below its 200-day moving average for most of the past few months. The stock’s PowerRating of 9 occurred just as the stock broke out above its 200-day moving average and fell back to test that level for support. As we saw with CREE, stocks testing their 200-day moving average support can be powerful gainers in a relatively short period of time when that test proves successful.

(

FCSX |

Quote |

Chart |

News |

PowerRating) has an exceptionally low PowerRating as recently as a week ago as a dramatic spike higher in the shares helped drive the stock’s rating down from a 4 to a 3. This PowerRatings downgrade was timely, as the stock immediately reversed and began moving lower, falling from just under $52 to just under $42 in a matter of days.

(

CREE |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 4.81

(

FBN |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 9. RSI(2) 5.98

(

FCSX |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 5.28

(

PANL |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 5.54

(

QSC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 2.79

(

TXCO |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2) 2.58