9 Overbought Stocks for Traders

Usually when you get nosebleed seats, it’s because you were trying to save money. But these nosebleed stocks, which have been showing uncharacteristic strength, may be about to lose investors money if they own them.

We have a number of indicators that are a part of our TradingMarkets Stock Indicators section that individually provide powerful evidence of markets that are overextended to the upside or downside. Any time a stock appears on our list of stocks that have advanced by 10% or more in the past few days or our list of stocks with 2-period Relative Strength Index values above 98–or even 99, then that is a stock that you want to be looking at as a candidate for correction.

And if a stock appears on both lists–being up big in a short period of time and virtually screaming “overbought” through the

2-period RSI–then we know we could have a special opportunity to the downside, indeed.

Today, the Indicators bring us not one such opportunity, not two such opportunities, but nine. Nine overbought stocks that have moved dramatically higher, to the tune of 10% or more, in just a few days.

Nine overbought stocks that have

2-period RSI values that are not just above 98, our typical threshold, but above 99, as well.

We have found that while a single indicator is often a strong signal, when multiple indicators are suggesting the same thing, the signal provided–bullish or bearish–is all the more powerful. Often traders wonder when they should press their bets and when they should proceed, but proceed with caution. Getting more than one signal at the same time–or even in consecutive days–is what traders who are looking to get aggressive should wait for.

The nine overbought stocks here all are displaying at least two conditions that suggest that the stocks are more vulnerable to correction than the average stock. The first condition, as I suggested above, was that they were all up 10% or more over the past five days. Our research tells us that stocks that are weak stocks, stocks that are trading below the 200-day moving average, are vulnerable to underperformance or even reversal when they advance big in a short period of time. And 10% is closer to the gains of average stocks in a year than it should be for weak stocks in a matter of days.

Click here

to read our research into stocks that have been up 10% or more in five days or less.

The other indicator involved in putting this list of overbought stock together is the 2-period RSI. I’ve made no secret of my appreciation toward this indictor, which Larry Connors and Ashton Dorkins introduced as a key tool for short-term traders last year.

(Click here

to read out research into short-term trading and the 2-period Relative Strength Index.) As a technician, I’ve never been a fan of the Relative Strength Index, preferring other oscillators which I found more effective. That was, at least, until the modifications Connors and his research team made to the traditional Relative Strength Index, modifications which made the indicator both far more sensitive to short-term price action, as well as making it harder for stocks to truly qualify as oversold or overbought.

In finishing off this list, I raised the overbought threshold a notch higher from the 98 we usually screen for to 99. And there were still a healthy number of opportunities for traders looking to fade the weak stocks buoyed by the market’s recent rising tide. The nine stocks are ranked first by PowerRating, then by their 2-period RSI.

Tenaris S.A.

(

TS |

Quote |

Chart |

News |

PowerRating). PowerRating 3. RSI(2) 99.66. See chart below.

Axa ADS

(

AXA |

Quote |

Chart |

News |

PowerRating) PowerRating 3. RSI(2) 99.18

ING Group N.V.

(

ING |

Quote |

Chart |

News |

PowerRating) PowerRating 3. RSI(2) 99.15

Nalco Holdings Inc.

(

NLC |

Quote |

Chart |

News |

PowerRating) PowerRating 3. RSI(2) 99.04. See chart below.

Amcol International Corporation

(

ACO |

Quote |

Chart |

News |

PowerRating) PowerRating 2. RSI(2) 99.98

Parallel Petroleum Corporation

(

PLLL |

Quote |

Chart |

News |

PowerRating).

PowerRating 2. RSI(2) 99.63. See chart below.

Terex Corporation

(

TEX |

Quote |

Chart |

News |

PowerRating). PowerRating 2.

RSI(2) 99.63. See chart below.

Braskem S.A.

(

BAK |

Quote |

Chart |

News |

PowerRating) PowerRating 2. RSI(2) 99.08

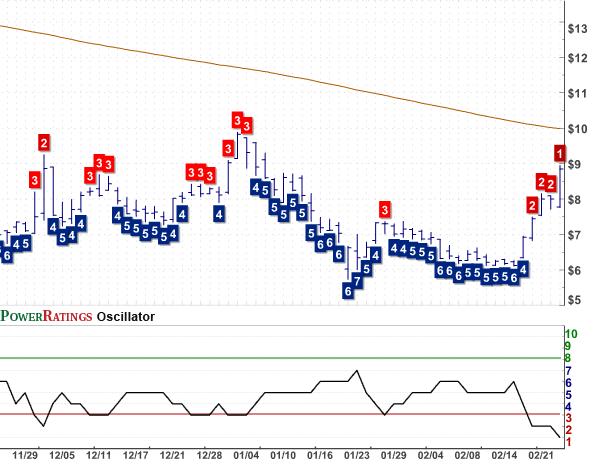

Gammon Lake Resources

(

GRS |

Quote |

Chart |

News |

PowerRating) PowerRating 1.

RSI(2) 99.67. See chart below.