Ebay-kruptcy?

Each morning this

list will contain those stocks with the potential to make a quick but tradable

move in the first hour. The information listed here is designed for the

trader who catches the early morning momentum, between the first five and 45

minutes of trading. Many stocks open each morning, run for several points and

then reverse. I will cover stocks with this potential and highlight possible

reversal points and resistance areas. These points need to be monitored closely,

as the stocks may turn quickly here. Be ready to lock in profits quickly.

Morning Outlook

Watch for a turnaround in the first 10-30

minutes of trading. Keep an eye on the stocks that gap the most in the morning.

Use the Nasdaq tracking stock (QQQ)

or futures as leading indicators.

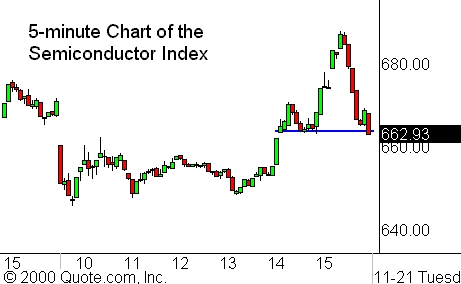

Almost every

sector that I follow was hurting yesterday, despite several attempts to rally

intraday. The semis gave up their fight before the day ended, but they did hold

the breakout level. Of course, on an intraday basis, this does not mean much.

The banks signaled weakness right from the open, as they

plummeted to the lows of the day right off the bat.

These two indices, which you often see me referring to, are

often very good indicators of where the market is headed.

One To Watch:

(

EBAY |

Quote |

Chart |

News |

PowerRating)

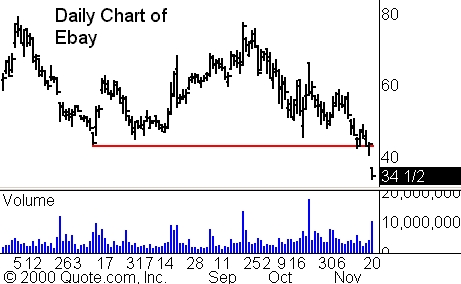

A truly sad sign of the times is when an analyst, who had a buy recommendation

on a stock while it tumbled over 65%, downgrades that stock and still has

followers who sell on his tip. Who out there possibly still listens to this

person’s call on the stock? On that note, Ebay

(

EBAY |

Quote |

Chart |

News |

PowerRating) took out what

remained of its support on Monday. It basically gapped down and made two

attempts to recover. Clearly, both failed. Watch for Ebay to put in a

continuation move and trade below Monday’s intraday low. Set your alerts near 33

3/4 and watch for another breakdown.

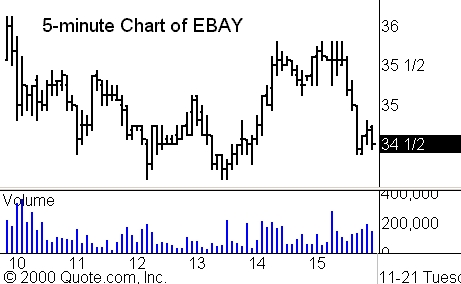

As you can see from the five-minute chart, despite two attempts

to recover, the stock still closed on its lows.

Just to play devil’s advocate, one thing I will say is that I was

always taught that the day a mega-bullish analyst downgrades a stock is usually

the bottom.