Give Me Something to Lean On: Understanding The Purpose Of Chart Patterns

10.0pt;font-family:Arial;color:black”>

Good afternoon

and welcome to TraderTalk. Today we have with us a gentleman who holds a CMT

designation, has worked as a price risk manager for the Louis Dreyfus

Corporation, and has written articles for Stocks and Commodities

magazine. He

began his career in 1988 as a cash agricultural commodities trader. He currently

is a proprietary trader for a NYSE member firm. It is my great pleasure to

introduce Mr. Dan Chesler…

10.0pt;font-family:Arial;color:black”>: Thank you Brice, for that introduction.

And thank you also to all the traders who have taken time to join us today.

Before I begin I just want to say that my association with TradingMarkets which

began in May has been a very happy one. Most you who have been with TM for any

length of time know the quality of the content contained on this site, and the

caliber of people here, are the best in the business. It is truly an honor to

work with folks like Larry, Brice, Duke, Dave et al.

The topic of my conversation today is on chart patterns. And more generally, on

the subject of trading. Along the way to becoming a full time trader, you really

need to decide what you believe in. You can’t be without some kind of consistent

approach to the market. I’m not mechanical or “system” trader, but I do have a

set of beliefs about the market that took a few years to develop.

Without some kind of roadmap that tells you where you are in the market, you

will be lost. So my advice to any new traders is to take your time until you

find that approach or technique that really “speaks to you.” I use chart

patterns as a means of trading first, and forecasting second.

That probably contradicts what some of you believe about chart patterns. The

truth is most chart patterns are at best a 50/50 proposition. Some are a little

better than others, but overall they’re only mildly predictive. However, chart

patterns serve a very useful function for trading.

color:blue”>SPECIFIC10.0pt;font-family:Arial;color:blue”>

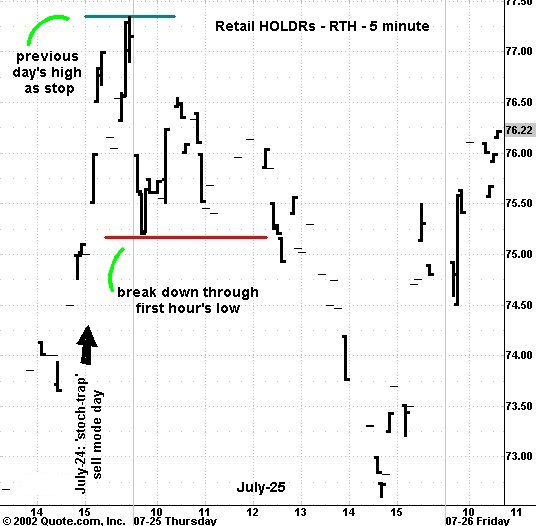

stoch-trap

(ST), and the

incipient trend pattern (ITP). In

addition, I am a big proponent of classical chart patterns. This is a very

subjective area for most folks. In my own trading, after enough years of

experience, I’ve gotten to the point where I know how to treat “subjective”

patterns as objective ones, but I’m not going to get into that topic in this

discussion. Basically it’s a technique that involves distilling the bar chart

down into separate volatility and periodicity components. Maybe we can talk

about that another day.

font-family:Arial;color:black”>

10.0pt;font-family:Arial;color:black”>

font-family:Arial;color:black”>

font-family:Arial;color:blue”>:

font-family:Arial;color:blue”>Dan, do you suggest using the SMA 50 or the MACD

5/35 as the second condition for a Stoch Trap? The Stoch Trap strategy I made

for TradeStation uses the SMA 50 because it’s slightly simpler to implement.

Also, how did you choose the 5/35 MACD numbers?

font-family:Arial;color:black”> I’ve used them both and there’s not much

difference between them. I like to use the 5/35 MACD for bigger picture

analysis, and so if I’ve got the MACD on my charts, I’ll sometimes just leave it

there rather than switching over to the 50 day average. But really it makes very

little difference.

font-family:Arial;color:black”>

font-family:Arial;color:black”>Like Austin Powers says in his movie, “That’s not

my bag, baby!” Forecasting is secondary to trading. Trading is about making

money. The only forecasting I do is in terms of predicting whether markets are

near a point where there are about to move “efficiently” or not. I don’t care if

I get the direction wrong seven times out of ten times, so long as my losing

trades are small. The other three are going to more than make up for the losers,

plus increase my account balance. I think Brice wants to wrap up now. So thanks

again for being here today and good luck in the markets tomorrow

font-family:Arial;color:black”> You bet. Dan, thanks for a fantastic

presentation. Thanks again, Dan, and

good trading to all!

![]()

For The Best Trading

Books, Video Courses and Software To Improve Your Trading