Is The Retail Sector Just A Devil With A Red Dress On?

Let me start

today’s column by saying two words……….CHA CHING!

We took profits on our brokerage

shorts which gained nearly 10% as well as booking

some nice gains in the tech sector from our long positions initiated

this morning, even after

(

AMCC |

Quote |

Chart |

News |

PowerRating)

(Applied Micro Circuits) cut the cheese pre-market

with a confession regarding major order cancellations.

To round it out, we saw both

(

RJR |

Quote |

Chart |

News |

PowerRating)

and

(

MO |

Quote |

Chart |

News |

PowerRating) pay us from the short side today.

Double play completed.

We are now beginning to see the

aftermarket CNBC specials on the retailing and

apparel groups as they are now the chic new sectors. Prior to this, we

saw pre-market hype and

aftermarket television special segments on the drug stocks

(which tanked soon thereafter) and the brokers (which topped immediately

after we went short last week). With Consumer Confidence hovering around

historical lows and spending slowing considerably, it is clear

that the consumer is a bit more selective of how he/she spends their

money. Is there a sound

economic reason retail and apparel stocks are being bid

up with such fervor? Or are we again witnessing more speculation of the

mythical second-half

recovery’? There was a question posed to a retail sector analyst

on CNBC aftermarket as to whether profits should be taken after the

recent gains in the

sector. (She essentially avoided a direct response.) You

be the judge.

Take a look at these charts below.

If they were technology stocks, we would

be hearing about how

overvalued they are.

Daily chart of

(

MAY |

Quote |

Chart |

News |

PowerRating) (May

Department Stores):

As seen above MAY has doubled from its

October 2000 lows.

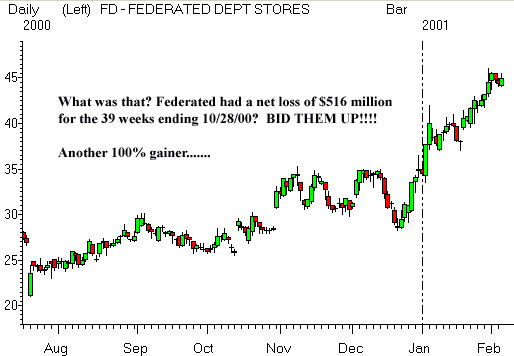

Federated Dept. Stores has also

doubled from last summer.

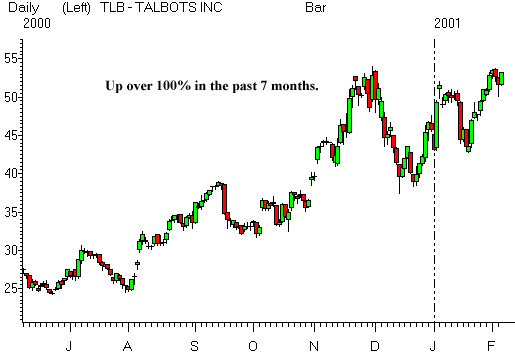

Women’s apparel company Talbots Inc.

has recorded a gain of nearly 230% in the

past 12 months. I currently have a call into management regarding a

rumor that they will soon

be producing fiber-optics components.

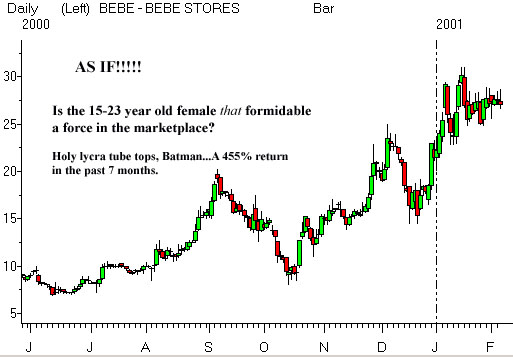

How many tiny t-shirts and lycra

clothing does the world really need? You be the

judge.

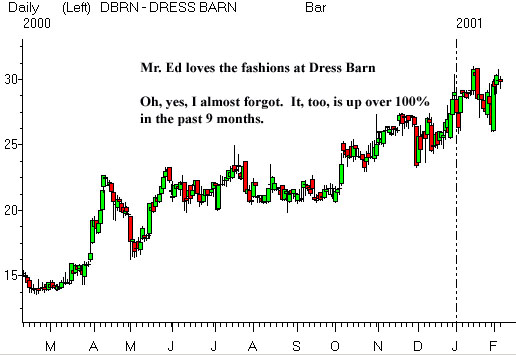

Dress Barn. I didn’t believe it when I

saw it in the motion picture “Twister,” but I guess pigs really do fly

in tornados.

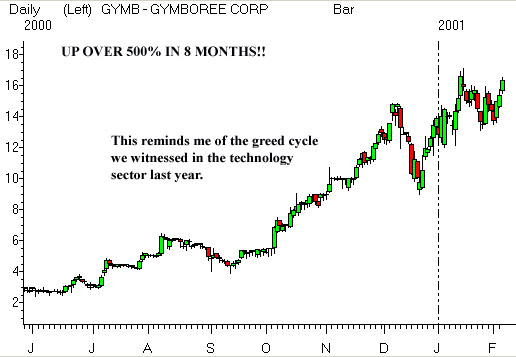

Up over 500% in the past eight months,

Gymboree Corp. must be the 800 lb. gorilla of

the children’s clothing industry. By the way, the company loses money

much like many of the

internet stocks did. Wall Street makes fun of the investor

who bought internet stocks that lost money. Why is this different?

Would someone check my

pulse?

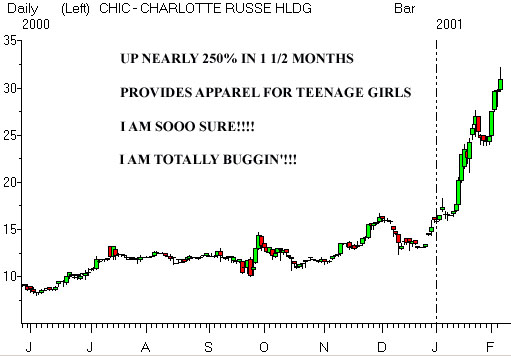

Charlotte Russe Holdings Inc., or

(

CHIC |

Quote |

Chart |

News |

PowerRating),

is a “mall-based specialty retailer of

value-priced apparel and accessories targeting young women between the age

of 15-35.” With a PE

ratio of 30+ and trading at roughly 8x book value, CHIC has

certainly transcended traditional valuations in the retail apparel sector.

I present these charts to you so you

can do your own technical analysis on them. Use your tools and your methods to

determine if they present good opportunities.

More times than not, many are clueless (no pun intended) as to

when a change of trend is beginning to take shape. Only through technical

analysis can these

opportunities be determined.

As I write this, Cisco Systems just

carpet bombed the tech sector with an ugly

earnings miss. I don’t have any information on the conference call at

this time.

Be careful out there.

Goran