Off Schedule

What I am wondering right now is what is going to happen in October? With the

traumatic decline from April, I’m curious if everything will be thrown off

schedule. We did not see the traditional return to strong volume after Labor

Day, but I think that people were expecting too much. It seems that people are

only going to call two-billion-share days high-volume days.

Today’s Watchlist:Â

(

RVSN |

Quote |

Chart |

News |

PowerRating),

(

NTPA |

Quote |

Chart |

News |

PowerRating),

(

SCMR |

Quote |

Chart |

News |

PowerRating)

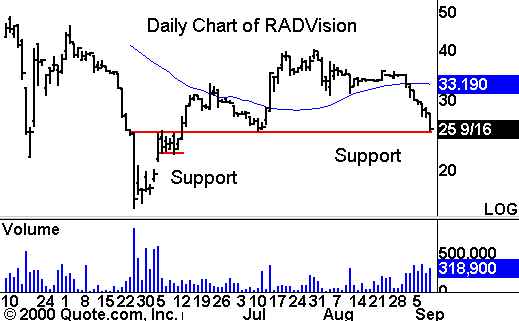

When I looked at Radvision

(

RVSN |

Quote |

Chart |

News |

PowerRating)

last night, I saw a nice short setup, as you can see from the chart below.

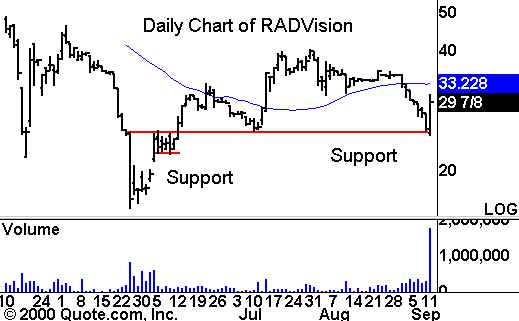

Looking at Monday’s chart,

I’m not sure what to think. The question is, will it break the 50-day MA?Â

I would continue to watch RVSN for a short opportunity. Set your alerts near

Friday’s intraday lows.

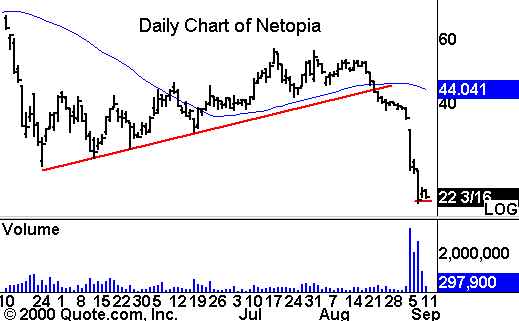

Netopia

(

NTPA |

Quote |

Chart |

News |

PowerRating) is

consolidating near its recent lows. The high volume move lower followed by the

descending volume during the consolidation suggests that this may just be pause

before a continuation lower. Watch for another move below the intraday low from

Thursday. The stock has been suffering since breaking its long-term uptrend.

Sycamore

(

SCMR |

Quote |

Chart |

News |

PowerRating)

closed just under its intermediate-term uptrending line on Friday. On Monday it

rebounded after the open, perhaps suggesting that buyers have come to the

rescue. Traders should watch for a move back above the 50-day MA, which

may act as resistance. On the other hand, continue to watch for a move below

Friday’s intraday low, which would signal that the sellers are in control.

Sycamore is known for trending with the market, so look for it to move with the

rest of the techs.

Until later,Â