Oldies And Goodies

Today’s Watchlist:Â

(

YHOO |

Quote |

Chart |

News |

PowerRating),

(

METHA |

Quote |

Chart |

News |

PowerRating),

(

INTC |

Quote |

Chart |

News |

PowerRating),

(

LH |

Quote |

Chart |

News |

PowerRating)

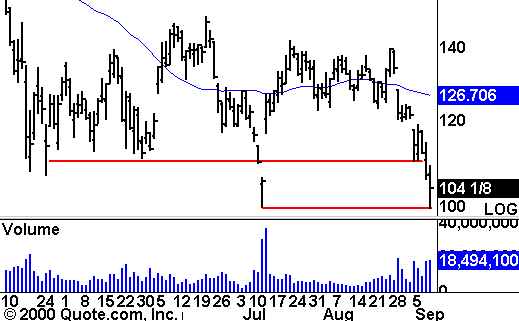

It looks like Yahoo

(

YHOO |

Quote |

Chart |

News |

PowerRating)

bounced off secondary support on Friday, but was unable to move back above the

new resistance level. The support level that was tested on Friday is backed by

psychological support at 100. Aggressive traders may want to watch for a short

opportunity on a break below 100. Most conservative traders should watch for a

closing move below this level. Also noteworthy is the recent high volume.

Methode Electronics

(

METHA |

Quote |

Chart |

News |

PowerRating)

was consolidating near resistance all last week and finally broke down on

Friday. The stock has traced out this formation several times in the last few

months at different levels. While it looks bad over the near-term, the bigger

picture appears to be tracing a cup formation. Based on this setup, we

will set our alerts near the 61 – 62 area. Watch for a move back above this

level to potentially result to trading back at the previous high. The move lower

on Friday was on lighter volume, which may signify that the move is only a

short-term issue.

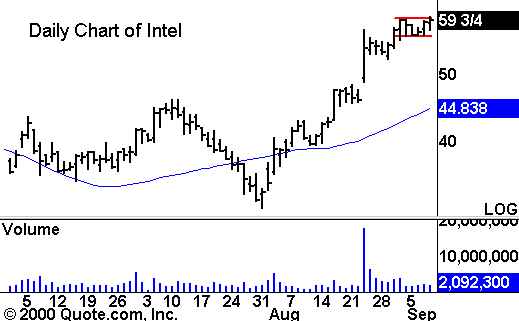

Intel

(

INTC |

Quote |

Chart |

News |

PowerRating) is

trading in a consolidation pattern. The volume has been textbook for this type

of pattern, meaning consistent. Watch for a volume-backed move outside of the

trading range. The near-term trend for INTC has been up, so it may continue in

this direction. Set your alerts near 60 as we watch for another move higher. Of

course, it could break to the downside, in which case, there may be support near

55 and 50. INTC is a leader and may trend with the broader market.

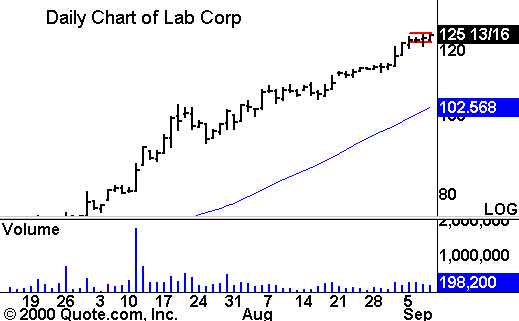

Another consolidation

pattern that is worth taking a look at is Laboratory Corporation. As with Intel,

watch for a move outside of the trading range. The stock has been trending

higher for several months and seen only a few minor pullbacks.

Until later,Â

Do you have a follow-up question about something in this column or other questions about trading stocks, futures, options or funds? Let our expert contributors provide answers in the TradingMarkets Question & Answer section! E-mail your question to questions@tradingmarkets.com.

For the latest answers to subscriber questions, check out the Q&A section, linked at the bottom-right section of the TradingMarkets.com home page.