Pick A Team

Each morning this

list will contain those stocks with the potential to make a quick but tradable

move in the first hour. The information listed here is designed for the

trader who catches the early morning momentum, between the first five and 45

minutes of trading. Many stocks open each morning, run for several points and

then reverse. I will cover stocks with this potential and highlight possible

reversal points and resistance areas. These points need to be monitored closely,

as the stocks may turn quickly here. Be ready to lock in profits quickly.

Morning Outlook

Watch for a turnaround in the first 10-30

minutes of trading. Keep an eye on the stocks that gap the most in the morning.

Use the Nasdaq tracking stock (QQQ)

or futures as leading indicators.

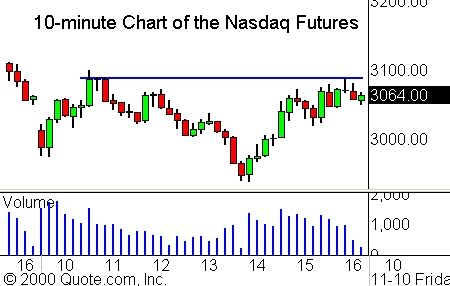

Uncertainty

continues to pervade the market, causing excessive volatility. Looking at

Thursday’s 10-minute chart of the Nasdaq futures, one can see just how crazy

things were. Near 2:00PM ET, the Nadsaq futures re-opened after being locked.

The S&P futures then reopened a few moments later, resulting in a market

bottom. It is times like those that you pray you do not get caught in short-covering. Many of the big names recovered, and quickly. If you were long,

congratulations!

The SOX made a nice recovery as well, rallying all the way back

to its morning highs, and ending the day positive.

Sadly, all of this uncertainty has ruined so many of the

beautiful patterns in many of the biggest names. Alas, the market has again been distracted by other world issues.

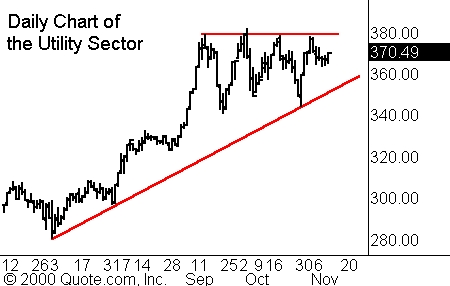

The question is, which sectors are acting well through all of

this? The utility sector, for one, remains a defensive group, and continues to

trade in a consolidation pattern with a bigger-picture ascending triangle.

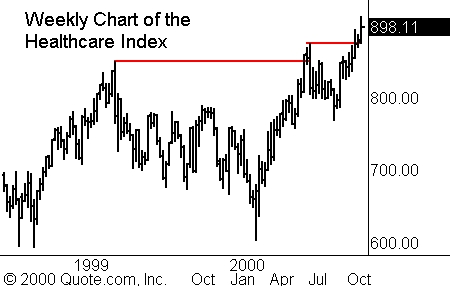

The healthcare sector is also a strong performer, moving north

in an uptrending channel.

In fact, the weekly chart shows a breakout from a

cup-with-handle formation.

Despite what many people think, it is possible to daytrade

utilities and healthcare stocks, especially when the scared money is looking for

a home.

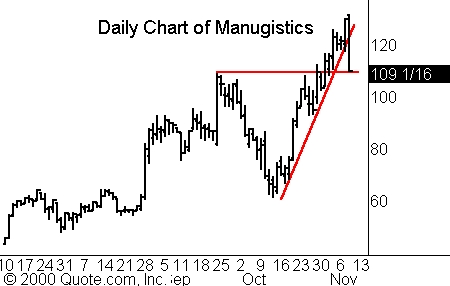

One To Watch:

(

MANU |

Quote |

Chart |

News |

PowerRating)

Manugistics

(

MANU |

Quote |

Chart |

News |

PowerRating) is sitting at a key pivot point. It

broke through the trendline which was so efficiently guiding it higher. Closing

on its lows on Thursday, it found support just a notch below the breakout

level. Watch for a continuation move on Friday to offer an addition short

opportunity. If the market is strong, or if some sense of security returns, the

stock may reverse.

If you are playing the short side at all today, I

remind you to trail your stops. Looking above, you can see just what

happened when the shorts ran for cover. Anyone on the wrong side of those trades

went home a bit sore.

Until later,

David Baker