Plan B

If the tech sector fails to continue this rally, and it’s nothing more than a

trap, it will be good to have several potential shorts waiting in the wings.

While I still see the near-term trend as up, it is always good to keep your

options open.

In Trading The Techs PM, out at 2:00PM ET, I will take a look at some long

plays.

This morning, let’s take a look at several short setups.

Today’s Tech Watchlist:Â

(

CREE |

Quote |

Chart |

News |

PowerRating),

(

DIGL |

Quote |

Chart |

News |

PowerRating),

(

YHOO |

Quote |

Chart |

News |

PowerRating)

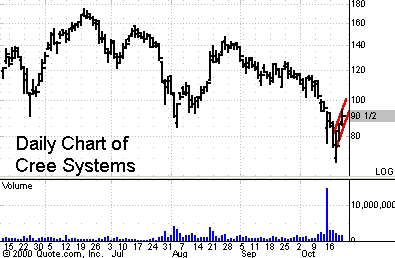

Cree Systems

(

CREE |

Quote |

Chart |

News |

PowerRating) has been trying to rally off its lows

for the past four days. Unfortunately, the rally has taken place on rather low

volume, compared to that of the moves in the other names in the Composite. For

this reason, its comeback is a bit suspect.Â

What we will watch for at this point is a breakdown from the

near-term uptrending channel. Despite each attempt to rally, including Monday’s,

the stock has continued to pull back to its opening price. Further, there is

likely resistance near 100. Watch for a failed move toward the 100 area. CREE

remains below its 50-day MA.Â

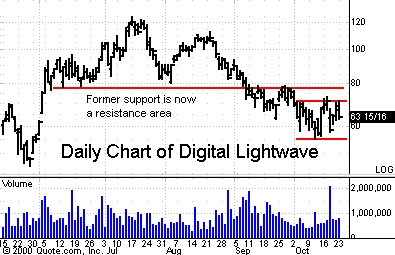

Another name which has seen little positive price action during the Nasdaq’s 17%

three-day surge is Digital Lightwave

(

DIGL |

Quote |

Chart |

News |

PowerRating). It remains in a consolidation

pattern close to its near-term low, between roughly 56 and 70. As for the

volume, nothing stellar in that department either. Recently, it tried to move

back above a former support level, which has become resistance, and failed. With

a negative cloud still hanging over the stock, it is one to keep on the short

list.

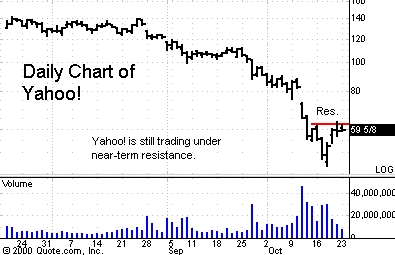

The weakest spot in the tech sector is still the Internet. Yahoo!

(

YHOO |

Quote |

Chart |

News |

PowerRating),

which is a key member of the group, has a chart pattern which confirms this. It

has also seen little positive action in light of the recent Nasdaq movements.

Yahoo! is poised for both a low-level breakout and a short on a failed rally.

On the long side, watch for it to take out the near-term

resistance level that I have highlighted on the chart. On the short side, look

for a failed move above this level and a pullback to the low that it set only a

few days ago.

Â

Until later,Â