President Naz

Each morning this

list will contain those stocks with the potential to make a quick but tradable

move in the first hour. The information listed here is designed for the

trader who catches the early morning momentum, between the first five and 45

minutes of trading. Many stocks open each morning, run for several points and

then reverse. I will cover stocks with this potential and highlight possible

reversal points and resistance areas. These points need to be monitored closely,

as the stocks may turn quickly here. Be ready to lock in profits quickly.

Morning Outlook

Watch for a turnaround in the first 10-30

minutes of trading. Keep an eye on the stocks that gap the most in the morning.

Use the Nasdaq tracking stock (QQQ)

or futures as leading indicators. Look for the indexes to fill the gap.

Perhaps the

election is moving the market? It is likely that it will only last for a short

time.

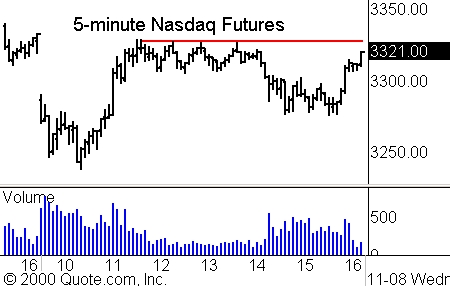

The intraday

chart of the Nasdaq futures from Tuesday shows that there was resistance at 3300.

Should we gap over this level, look for it to act as support.

Tuesday’s One to Watch, an Oracle

(

ORCL |

Quote |

Chart |

News |

PowerRating) short, ended the

day near its lows.

One to

Watch:

(

GSPN |

Quote |

Chart |

News |

PowerRating)

Globespan

(

GSPN |

Quote |

Chart |

News |

PowerRating)

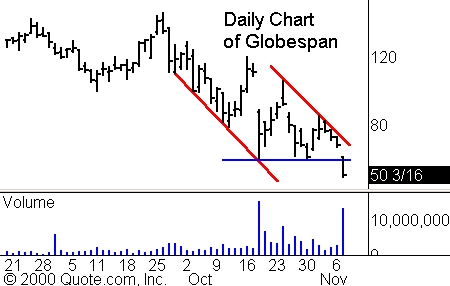

is on the volatile semiconductor group. It has been traveling in a wide downward

channel for the last five weeks. Globespan entered the channel after failing to

break out from a high level cup pattern. On Tuesday, it gapped down and closed

below support. The move was complemented by heavy trading, as over 10 million

shares changed hands.

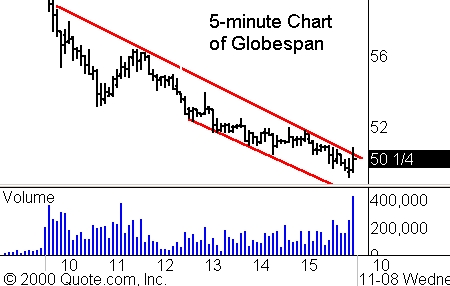

The five-minute chart of the stock shows us what happened after

it broke support in the early morning. After making a strong move to the

downside, it tried to rally back and failed. This bounce created the downward

trendline which would guide the stock lower over the course of the day. With

potential psychological support at 50, we will watch for a move below this level

to take it lower.