Rouge

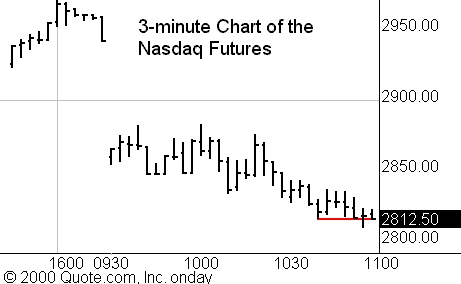

It is not pretty. The Nasdaq has been getting progressively worse since the

open. What looked like a gap-filling opportunity turned out to be just another

short entry. The last print across the tape was 2795.

Now both the banks are at the low of the day and the

semiconductors are rolling over, intraday.Â

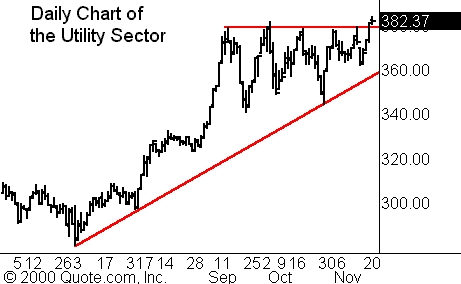

On the other side of the market, the strong side, the same group

that I mentioned last week was, the Utilities.Â

My insight for the day is that you need to adjust your strategy

a little for this market. For example, while I usually have a long list of daily

setups that I watch for opportunities, I am presently focusing on more intraday

patterns, primarily short-term reversals and bounces.Â

Lastly, a word on shorts. Do be careful on any short, as many

stocks are quite oversold and many people are looking for a bottom. A rally,

whether just a bull trap, a relief rally, or a bottom, will likely be strong.

Today’s Watchlist:Â

(

CHKP |

Quote |

Chart |

News |

PowerRating)

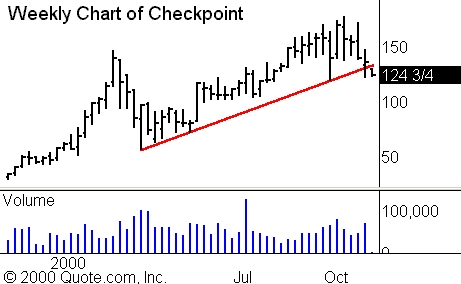

Checkpoint

(

CHKP |

Quote |

Chart |

News |

PowerRating) is a member of

one of the last groups to show weakness, the software companies. Many of the

names in this group have actually held up very well, relative to the rest of the

tech sector. Unfortunately, the reaper may be coming for them now. Perhaps led

by continued weakness in Oracle (the once, and perhaps still, leader in the

group), Checkpoint has broken the weekly trendline that had been guiding it

higher since the beginning of the year. At this point, we will watch for a move

below the low of last week. Set your alerts accordingly and watch for a short

opportunity in a weak market.

Â

Â

Until later,