Sectorz

With all of this talk of “the market,” I thought that

we could take a minute to separate the diferent parts of the market. Just

because an index of 30 stocks moves one way or another, that does not mean that

all 11,000 stocks are doing the same thing.

It’s time for a sector checkup.

Today’s Sector Checkup:

(

IUX |

Quote |

Chart |

News |

PowerRating),

(

BKX |

Quote |

Chart |

News |

PowerRating),

(

DOT |

Quote |

Chart |

News |

PowerRating),

(

SOX |

Quote |

Chart |

News |

PowerRating)

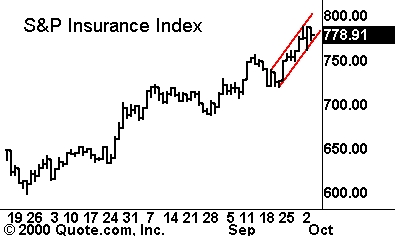

Starting with the two

strongest sectors in the market, we have insurance and banking. Sure, they do

not move 10 to 20 points a day, but if you do not have a short button on your

keyboard, you should take a look.

The S&P Insurance Sector

(

IUX |

Quote |

Chart |

News |

PowerRating) has been setting new highs as it continues to trend in this

upward channel. With some resistance just under 800, the index remains poised to

move higher. As history has shown, investors tend to flock to defensive names in

this sector, among others, when growth stocks get “iffy.”

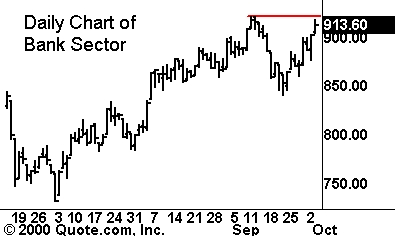

The S&P Banking Index

(

BKX |

Quote |

Chart |

News |

PowerRating) is forming a high-level

saucer pattern just under its all-time high. While it retraced during the last

tech rally, it quickly ran back up when techs started to shake people out.

Again, banks are often considered defensive, yet they do see some volatility

when the issue of interest rates comes up. Look for a new high breakout as

traders look for safe names to move their money into. Safe, of course, being a

relative term.

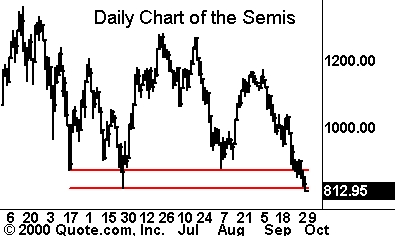

On the weaker side, we have two of the tech indices.

The semis

(

SOX |

Quote |

Chart |

News |

PowerRating) have been hurting for some time now, and

Intel just added insult to injury. The SOX broke below the two most obvious

support levels on the daily charts in the last few weeks. After setting two

lower double tops, the index tried to rally back once again, only to ultimately

cave in. Do not give up all hope if you hold positions in your account which

fall in the category. As you know, markets often tend to break major support

levels just before putting in a bottom. I am by no means calling for a bottom,

it’s simply something to remember when rearranging your portfolio. Short-term

traders should watch members of the sector for more near-term weakness.

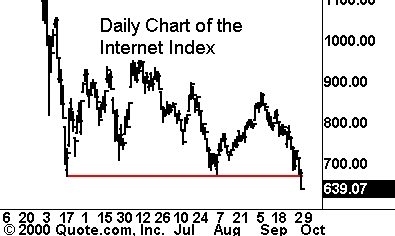

The other part of the tech sector which is particularly weak is

the Internet group. The group took out its five-month-old support level on

Tuesday when it closed at 639. The members of the group continue to be bashed by

both the media and investors. With dot.com money rumored to be drying up, and

advertisers disappearing, there is a question of how much cash these companies

have left to burn. The near-term picture looks bleak, but the Internet is still

the center of the modern information age, so there are still prospects out

there.

Until later,Â