Semis Say Sell

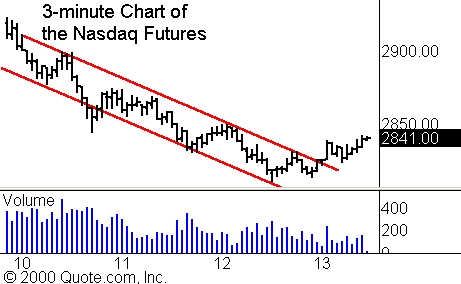

There is, once again, little to say about the tech sector intraday. It seems

that we have followed the usual pattern: morning rally, followed by a selloff,

and then a recovery. We are currently in the recovery phase. But, please note that the semis are weak, and as I mentioned earlier, they are forecasting another selloff.

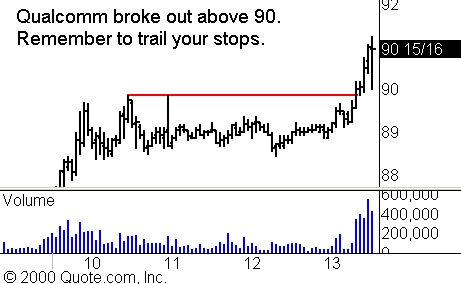

Qualcomm

(

QCOM |

Quote |

Chart |

News |

PowerRating), which I mentioned as one to watch for a

move over 90, continues to power higher. If you took a long position based on my

breakout point, remember to trail your stops, so as not to give back any

profits. The most bullish factor about QCOM today is that it is breaking out

while the Nasdaq is only beginning to recover, suggesting that there is more

upside potential.

Today’s Watchlist:Â

(

NOK |

Quote |

Chart |

News |

PowerRating),

(

AMD |

Quote |

Chart |

News |

PowerRating)

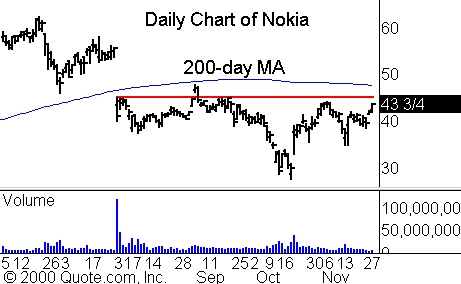

Nokia

(

NOK |

Quote |

Chart |

News |

PowerRating), along with much of the

telecom group, has had quite a bit of trouble recently. After spending some time

settling down, the stock has moved off its lows. Although Nokia is still several

points below the breakout level, it would be prudent to add it to our watchlist.

Set your alerts for a move near 45 1/4, at which point it may head toward the

200-day MA. Should it be able to trade above the 200-day MA, it may try to fill

the gap from July. This would provide a significant opportunity for profit.

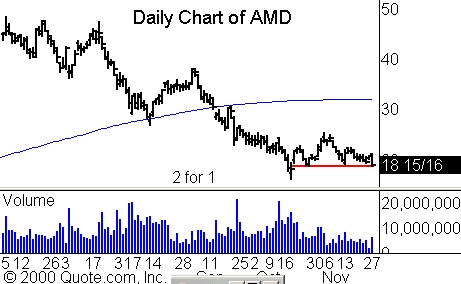

Every time I look at the semiconductor index, I think, “how

much lower can it really go.” Currently down another 5.30% on Monday, I

realize that it can go as low as it needs to.

On that note, AMD

(

AMD |

Quote |

Chart |

News |

PowerRating) has setup for another short opportunity. Because

it is already trading just over support on Monday, you may want to watch for it

to trade below the area highlighted below in the near future. Otherwise, watch

for a close below support and a continuation move on Tuesday to result in a test

of October’s low.

Â

Â

Until later,