Still Going

This morning I mentioned that the “trend was up.” It seems that we

have continued with that trend. The futures held 3080, another positive

sign.Â

As I mentioned on Monday, I was watching for Cisco to make a second close

under the 50 mark that so many people have called the key level. It rallied back

within the first hour of trading, which is a positive sign

Currently, Cisco is completing an intraday cup with handle. Intraday

resistance remains at 52.

Once again, the daily chart patterns are getting chopped up, so

I will take a look at several intraday setups.

Before we move forward with a plan for the rest of the day, let’s

see where the various tech groups stand.

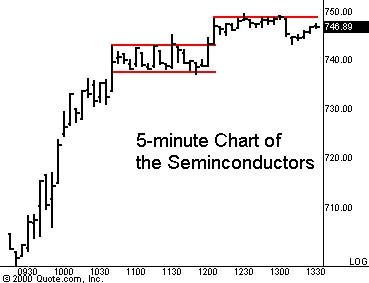

The Semiconductors

(

SOX |

Quote |

Chart |

News |

PowerRating) are consolidating once again near

their highs. Set your alerts for a break of 750.

On the other side of the market, the banking index is retesting

its highs as it completed an intraday cup pattern.

Â

Today’s Watchlist:Â

(

SDLI |

Quote |

Chart |

News |

PowerRating),

(

IDTI |

Quote |

Chart |

News |

PowerRating),

(

JDSU |

Quote |

Chart |

News |

PowerRating)

As the market settles down through the

lunch hour, many of the biggest names are consolidating, and setting up for us

daytraders. SDL Inc

(

SDLI |

Quote |

Chart |

News |

PowerRating), for those who like the volatile names, is

trading in a range near its highs, while still holding its uptrend.

Integrated Device Technology

(

IDTI |

Quote |

Chart |

News |

PowerRating) has formed an intraday

cup with handle and has started to break out from resistance.

JDS Uniphase

(

JDSU |

Quote |

Chart |

News |

PowerRating) is forming a bullish flag pattern on

its five-minute chart. In a rally, watch for a breakout from the short-term

descending channel to offer a long opportunity. In a weak market, look for a

move to the downside.

Remember that today is the last day for some mutual funds to complete their

tax loss selling, so expect volatility as the market on close orders appear.

Until later,