Support, A State Of Mind

Last night, Kevin Marder wrote “Often,

an index will undercut a widely-watched ‘support’ point on heavy

volume, only to shake out everyone and their brother, in the process creating a

durable bottom that ‘everyone’ thought wasn’t possible.” I

completely agree with his analysis. Always

keep this in mind when listening to the pundits and before you pull the trigger

on a trade.Â

Today’s Tech Watchlist:

(

ARBA |

Quote |

Chart |

News |

PowerRating),

(

SCMM |

Quote |

Chart |

News |

PowerRating),

(

SWCM |

Quote |

Chart |

News |

PowerRating)

Ariba

(

ARBA |

Quote |

Chart |

News |

PowerRating) is one of many big-name stocks getting slaughtered. Whenever I see increased volatility in a stock,

it’s crucial to get a feel for the bigger picture. In the case of ARBA, it’s not

exactly beautiful. Last week, ARBA closed below weekly support, and it put in a

weekly continuation move on Monday. The volume is on track to be quite strong

this week, which, if coinciding with a bigger move, may not be pretty.

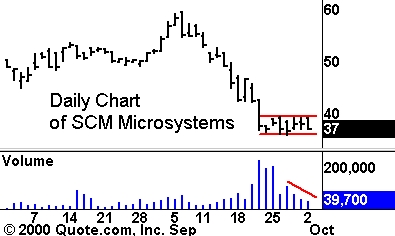

SCM Microsystems

(

SCMM |

Quote |

Chart |

News |

PowerRating) has

been in a consolidation pattern for the last two weeks. As I discussed in my

article this morning, it’s very important to always note the volume activity.

Once again we see decreasing volume coinciding with a consolidation pattern,

which suggests that a move may be coming. Set your alerts near the high and low

of the near-term trading range.

Software.com

(

SWCM |

Quote |

Chart |

News |

PowerRating) has retraced to its most recent

breakout level. There are both long and short opportunities here. On the short

side, watch for a break of this new support level, which formed on the breakout

above resistance. On the long side, look for the stock to form a small saucer

pattern and take out the final retracement day’s high, or, for the more

conservative trader, for it to take out the all-time high.

Until later,Â