Take What You Can Get

Today’s Tech Watchlist:Â

(

VRSN |

Quote |

Chart |

News |

PowerRating),

(

CVAS |

Quote |

Chart |

News |

PowerRating)

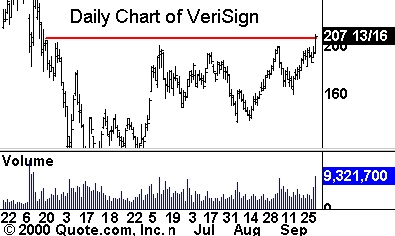

Personally, I am not a fan of low-level setups, because there is

often a lot of overhead supply. Yet, where there is momentum, we cannot argue.

In the case of Verisign, the move of the last two days have been sponsored by

accelerating volume. The close above the current resistance level was a

meaningful event, because of the heavy trade. Trouble may remain at each of the

highs from May, where sellers may still remain. Look for continued strength.

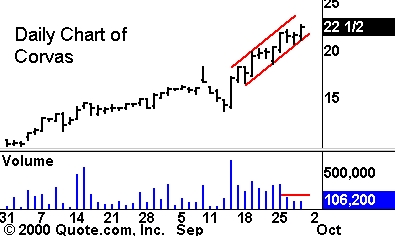

Corvas

(

CVAS |

Quote |

Chart |

News |

PowerRating) broke out earlier this month and has been

trending in an upward channel for the last two weeks. Within the channel there

have been two consolidations and mini-breakouts. The move on Thursday was a

third mini-breakout. Unfortunately, the move was not backed by volume, which

does make it a bit suspect. Set your alerts near the intraday high from

Thursday. Use the upper trendline of the channel to pick a resistance area, at

which point you may consider lightening your position, if you are long, or

trailing your stop a bit faster.

Today’s Non-Tech

Watchlist:Â

(

RDN |

Quote |

Chart |

News |

PowerRating)

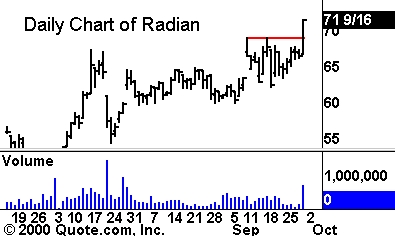

Radian

(

RDN |

Quote |

Chart |

News |

PowerRating) rallied on strong volume to a new high after

trading lightly for four days. The close at the high suggests that traders may be

serious about this move. As with any breakout, look for a continuation move to

take the stock to another new high. Ideally, there will be a pullback before the

next leg higher to flush out any weak hands.

Until later,Â