The G-Man Initiates Coverage Of AEOS With A

I want to

make it clear that I am merely trying to bring to light the recent

activity in one of the apparel retailers that has enjoyed a 500%+ run in the

past seven months. When

you look through the entire sector of apparel stocks and

retailers, you will see a similar trend of high volume insider selling

over the course of the

past few months. Let’s take a look at a few of them:

The first of which is American Eagle

Outfitters (AEOS). Yesterday, the Dow Jones

Newswire posted a summary of insider trading activity for this stock.

It read as follows:

FILER: SCHOTTENSTEIN, JAY L.

TITLE: Chairman of the Board

TRANSACTION: Sale: 1,700,000 — 01/05/01-01/11/01 — $46.27-$47.96

OWNERSHIP: 8,695,845

FILER: RETAIL VENTURES INC.

TITLE: Beneficial Owner

TRANSACTION: Sale: 1,000,000 — 01/05/01-01/11/01 — $46.27-$47.96

OWNERSHIP: 4,855,450

FILER: HOFFMAN, GERALDINE

SCHOTTENSTEIN

TITLE: Beneficial Owner

TRANSACTION: Sale: 800,000 — 01/05/01-01/11/01 — $46.27-$47.96

OWNERSHIP: 7,931,109

FILER: DESHE, ARI

TITLE: Director and Beneficial Owner

TRANSACTION: Sale: (Option Related) 210,500 — 01/05/01-01/11/01 —

$46.27-$49.17

OWNERSHIP: 4,015,779

FILER: KOLBER, GEORGE

TITLE: Officer and Director

TRANSACTION: Sale: 59,628 — 01/05/01-01/30/01 — $46.27-$96.00

OWNERSHIP: 256,878

FILER: LEEDY MICHAEL J

TITLE: Vice President

TRANSACTION: Sale: (Option Related) 42,417 — 01/12/01 — $50.03-$50.04

OWNERSHIP: 20,000

FILER: DOOLAN, MARTIN P

TITLE: Director

TRANSACTION: Sale: (Option Related) 11,500 — 01/09/01 — $48

OWNERSHIP: ZERO

FILER: MARAKAS, JOHN L

TITLE: Director

TRANSACTION: Sale: (Option Related) 19,500 — 01/31/01 — $57.25-.88

OWNERSHIP: 26,500

In addition, there were several

corporate sellers who blew out of much smaller

quantities of stock ranging from 4,000 shares to 10,000 shares. I only

listed the larger block sellers above.

If these insiders are selling such

enormous quantities of their own stock, why should

we be buying it?

The total of these insider sales for

the past month is around 3.8 million shares

of stock. The float on AEOS has been 12.1 million shares with 46.44

million shares outstanding. Keep in mind

that any insider sales come from the “shares

outstanding” number and are added to the float once they are sold on

the open market.

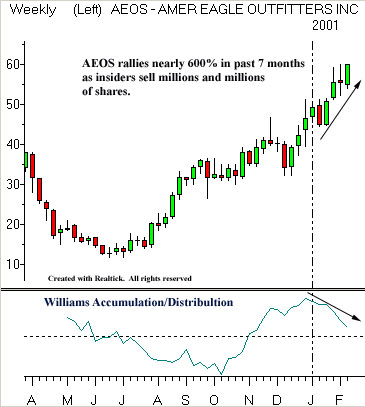

As you can see on the chart below,

AEOS has risen nearly 500% in the past seven months.

Yet after this incredible run and excessive insider sales, we have not

heard any warnings or negative comments from the analyst community.

Makes you wonder, eh?

The chart below clearly displays the

red carpet being laid out for the 3.8 million shares of AEOS that were sold last

month. There were millions more sold

by insiders during the prior six months.

The only slightly cautionary comments

I have found concerning AEOS were issued by analyst Janet Joseph Kloppenburg of

Robby Stephens:

“AEOS shares currently trade at

24.6x our $2.37 F2001 EPS estimate, a significant premium to the specialty

apparel peer group’s 16-17x F2001 P/E multiple…At

the shares’ current premium valuation, the stock appears to be

fully discounting the upside potential that we believe AEOS’s current

business momentum is

capable of generating. Therefore, we believe the shares

are best suited for longer-term oriented investors, given that near-term

appreciation may not be significant.”

Still, this analysts does not address

the unusually high insider selling activity

that has taken place with the stock.

The recent moves up by

stocks like AEOS have been somewhat counterintuitive in

the face of mounting layoffs, continuing slowing in the economy, falling

consumer confidence,

dismal holiday sales, and record consumer debt. Nevertheless,

it is the job of investment banking and brokerage arms to work hand

in hand in achieving the best possible results for their corporate

clientele. This similar

pattern of insider selling into retail buying is seen

throughout the retailing and apparel sectors as evidenced by stocks

like

(

TLB |

Quote |

Chart |

News |

PowerRating),

(

MAY |

Quote |

Chart |

News |

PowerRating),

(

MW |

Quote |

Chart |

News |

PowerRating) and

(

ANF |

Quote |

Chart |

News |

PowerRating).

From a fundamental perspective,

although AEOS and other specialty retailers have

been issuing news releases about their increases in sales totals, we

have not heard any

positive comments about the integrity of their profit margins.

In fact, it is widely known that retailers across the board deeply

discounted their

merchandise in December and January in order to decrease their

inventories.

This appears to be the same dilemma

that has plagued the personal computer manufacturers.

Sales numbers are healthy, but profit margins have suffered considerable

due to discounting.

Hey, AEOS insiders and analysts, The

Crocodile Hunter (Steve Irwin) just called. He wants all of you on his

“World’s Most Deadliest Snakes” show.

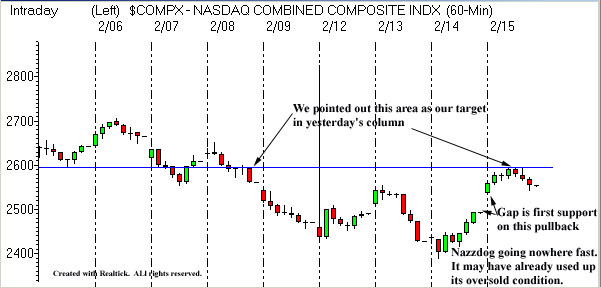

On to the other casino, the Nasdaq

Composite.

As seen in the chart above, the Nasdaq

Composite met resistance and turned back

down at the level I pointed out yesterday. As such, unless the market

can shrug off the

additional bad news it was handed aftermarket, it appears as

though this resistance will hold.

Isn’t it interesting that once again

we heard about all the institutional and mutual fund buying that took place

today, when in fact, the market was too weak

to break through primary resistance on a 60-minute chart?

After the close today, Nortel Networks

warned of a sharp first quarter earnings and revenue shortfall, saying that the

U.S. economic slowdown is “faster

and more severe” than it had expected. Also, it did not expect a

significant recovery in

the broader economy before the fourth quarter. In addition,

Nortel announced another 4,000 jobs would be slashed, on top of the

6,000 jobs already cut. In

addition, Dell Computer announced that it would lay

of 4% of its workforce and failed to meet its lowered EPS forecasts of

0.19 per share.

This market is looking like it is

operating in a plastic bubble that is unfazed by reality. It is only the

“perception” of reality that matters. If

I recall correctly, didn’t the crew of the Titanic have its orchestra play

on the deck to calm the

passengers as the ship was sinking?

Long Watch: After the

close today, nothing looks safe.

Short Watch: Same as yesterday, plus

technology if the NASDAQ doesn’t bounce immediately

after a possible gap down tomorrow morning.

Have a nice evening and a pleasant

tomorrow.

Goran