The One-Hour Bounce

Wednesday’s action in the Nasdaq does suggest a short-term

bottom, but short-term may only mean one hour. At this point, I still do not

feel good about taking home many positions overnight, though I did take home one

bellwether, based on a bullish tail. I hear the pundits each day calling tops and

bottoms. My thoughts: We’ll know a market bottom only after the fact.

Today’s Tech Watchlist:

(

NEWP |

Quote |

Chart |

News |

PowerRating),

(

AMCC |

Quote |

Chart |

News |

PowerRating)

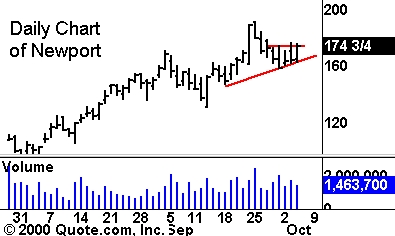

Newport

(

NEWP |

Quote |

Chart |

News |

PowerRating) has

showed a series of four higher lows. The near-term picture shows a small

ascending-triangle formation under the all-time high. If the market can gather

some strength, it may be able to retest the highs that it set not long ago. The

50-day MA has served as backing support since mid-May. Secondly, watch for a

high-level saucer pattern to form on a test of the former highs.

Â

Â

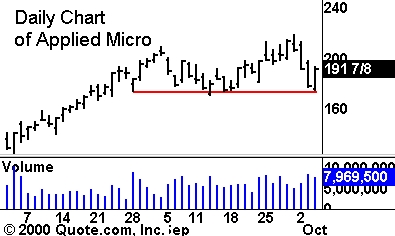

Applied Micro Circuits

(

AMCC |

Quote |

Chart |

News |

PowerRating) bounced off near-term support during

Wednesday’s mid-day recovery. The last four days have also traced out a 1-2-3-4

reversal pattern. If the market is strong, look for a move above Wednesday’s

intraday high. If we see more weakness, you’ll want to watch for a breakdown

below the support level that was just tested. Volume-wise, we have seen

consistency for the past few weeks, with only a few anomalies.

Until later,Â