The “Other” Index

Remember the Dow? It seems that no one ever talks about it anymore.Â

Where does it stand now? The world’s oldest average closed just under a new

resistance level, which was created by the break of support in early October. As

my crystal ball remains broken, only time will tell where it will go. Over the

near-term I am watching for a move above 10,600, followed by another rally over

the 50-day MA at 10776, and most importantly, over 11,000.

Today’s Watchlist:

(

ARTG |

Quote |

Chart |

News |

PowerRating),

(

JNPR |

Quote |

Chart |

News |

PowerRating)

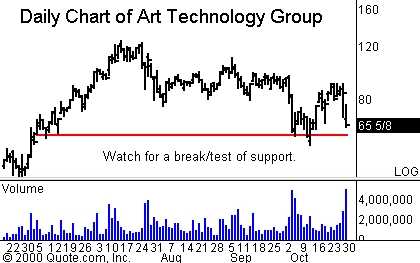

Art Technology Group

(

ARTG |

Quote |

Chart |

News |

PowerRating) is

poised to retest a prior support level. Despite an attempt to rally off its lows,

it was unable to break through the resistance formed during the consolidation of

August and September. Interestingly, the support level that I have highlighted

below is also near the 50% retracement level, based on the move from the May low

to the June high. Set your alerts near 60-61 and watch for a break below support

to offer a short opportunity. The selling on Friday was backed by greater than

300% volume, making the move a bit more significant.

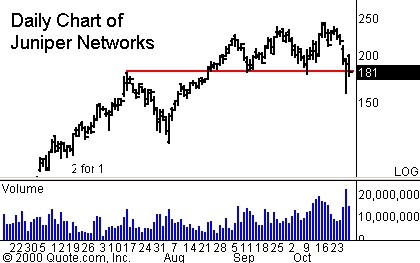

Juniper Networks

(

JNPR |

Quote |

Chart |

News |

PowerRating) closed below a pivot-point on Friday.Â

After making a serious retracement in June and July, JNPR broke out in

August and traded significantly higher for almost a month. It then retested the

breakout level on three occasions, until it finally broke in October. Buyers

came to the rescue on Thursday, but failed to appear by the close on Friday. At

this point, we will watch for another move relative to this key pivot-point. set

your alerts for both long and short opportunities. On the short side, watch for a

break of Friday’s intraday low to lead to a retest of the top of the

consolidation from August, where it may find support. Do not let yourself

get caught in any kind of short covering, trail your stops.

Until later,

Do you have a follow-up question about something in this column or other questions about trading stocks, futures, options or funds? Let our expert contributors provide answers in the TradingMarkets Question & Answer section! E-mail your question to questions@tradingmarkets.com.

For the latest answers to subscriber questions, check out the Q&A section, linked at the bottom-right section of the TradingMarkets.com home page.