The Power Of Gaps

Have you ever

noticed a stock or an index which seemed to be moving effortlessly

in its desired direction suddenly stop dead in its tracks? Have you

ever noticed how this often happens nowhere near a major moving average

or trend line? Do you

sometimes find yourself watching a trade reverse in your

face and not have an explanation as to why this happens?

More often than not, the answer can be

found by identifying areas of gaps on weekly,

daily and intraday charts. In order to determine all potential areas

of support and resistance when you are evaluating a trade (we all have

our targets and stops in

mind before we enter the trade, right? Right?) you must

always consider gap areas.

For clarification, the Japanese refer

to a gap as a “window.” Most of my charting

analysis is based on Japanese candlestick charting theory which was

primarily brought to

prominence in the United States by Steve

Nison. Nison is considered to be the

“Godfather” of Japanese candlestick analysis in the United

States. While Japanese candlestick analysis has really only been practiced

for the past 25 years in the United States (thanks to Steve Nison’s

research and work), the

Far East has been utilizing these principles and theories

for centuries.

There is a Japanese saying, “A

clever hawk hides its claws.” For those of us who

utilize candlesticks, we believe “the claws” of the market to be

hidden within

their message (from Nison, Beyond Candlesticks). Let

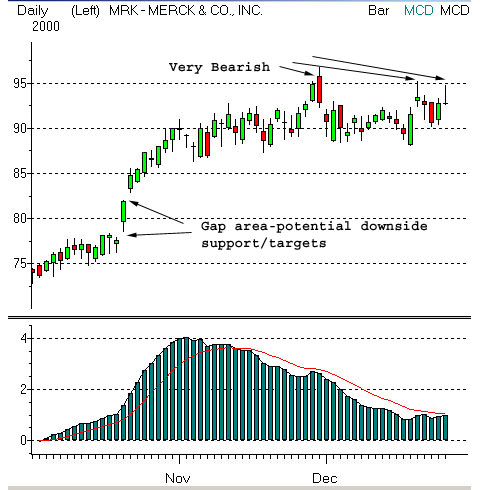

us consider the case of Merck and Co.

(

MRK |

Quote |

Chart |

News |

PowerRating). In my Dec. 27, 2000, commentary,

I pointed out the potential of Merck and Co. to fall out of its consolidation

range due to negative divergences with its technicals. I pointed

out potential target areas based on two windows which were formed on

gaps up in October, 2000.

Let’s go back and examine the chart from Dec. 27:

Now let’s take a look at MRK’s present

day chart and summarize what actually transpired

subsequent to my Dec. 27 commentary.

As we can clearly see, MRK fell

violently out of its trading range in early January,

2001. We can see a multiple-day effort to stabilize at the area of

gap #1 (as shown on

chart). However, this gap #1 zone was violated and the zone of gap #2 was

quickly tested. To date, the zone of gap #2 has halted a further

decline in the share price of MRK.

However, it is not certain as to

whether or not MRK can resume its prior uptrend

at this time. This is due to the prior support zone of gap #1 now serving

as resistance during rally attempts. Until this new resistance zone

of gap #1 can be overcome,

MRK appears to be locked in a trading range between

its new resistance area of gap #1 and its support zone of gap #2. A

break through either one

of these zones would suggest continuation in that direction.

Most who were observing the recent

trading activity of Merck and Co. may have been

perplexed by its trading pattern as it seemed to act in total disregard

for major moving averages

and trendlines. The key to having made a profitable

trade in this particular instance was identifying where the market

was “hiding its

claws.” The “claws,” as we have proven here, were hidden

within the gap areas

described above.

For The Best Trading

Books, Video Courses and Software To Improve Your Trading