The Year The Nasdaq Dropped The Chalupah!

With the Nasdaq Composite succumbing to relentless selling throughout the late morning and early afternoon, the reality of this year really sank in.

The worst year in history. Period. Closing the day at 2471.98, the Nasdaq Composite recorded a 40% loss for the year. Bulls were quick to call

today’s poor performance “last-day tax selling.” Whatever excuse you choose to use,

it wasn’t pretty. Thankfully, we were able to detect the topping action last night and entered the day ready to enter the shorts we were watching.

Unfortunately, when a stock is up 10+ points on a day, many don’t look at it from the short side. The key, however, is understanding the overall trend

of the stock and, if the trend is down, watch for rallies into resistance to short it. Yesterday, we called

(

JNPR |

Quote |

Chart |

News |

PowerRating),

(

BRCD |

Quote |

Chart |

News |

PowerRating),

(

EMLX |

Quote |

Chart |

News |

PowerRating),

(

PMCS |

Quote |

Chart |

News |

PowerRating) and

(

QLGC |

Quote |

Chart |

News |

PowerRating) as shorts

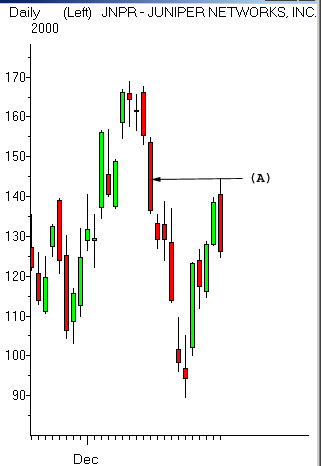

for today. All of them hit and paid us handsomely. Let’s look at an example: Juniper Networks.

Once Juniper exceeded yesterday’s high, the euphoria started to escalate. I got a call from a trader telling me

that JNPR was a “sure thing” to the 200-day MA at 149ish and there was NO resistance until there. My response was

simple: Au contraire, mon frere (I think not, you shmuck). Sometimes, traders put too much emphasis on major moving averages and forget to listen

to the messages that the candlesticks are sending us. Area (A), shown above, is the 50% point of the real body from the candlestick of 12/14 which

was roughly 144 1/4. The high today of Juniper was 144 1/2 before it commenced its death spiral to roughly 124. So as some traders were going

long and looking for a move to the 200-day MA, I was watching the 144 1/4 area to serve as resistance and entered a significant short position. Big red or big green candlesticks of this nature will often serve as

resistance/support. Only candlesticks can show you this.

Let’s now reflect on some of the madness we witnessed this year that will forever live in our memories:

No profits? No problem. David Wetherell, the CEO of

(

CMGI |

Quote |

Chart |

News |

PowerRating), states that he did not want to show a profit too early for his company because the market would

assign a PE (price to earnings ratio) to them. Good thinking. Doing such may have resulted in his firm losing over 96% of their market cap this

year. Er… um…. hold on a second…..

The “Harmon Effect.” Stocks like

(

USIT |

Quote |

Chart |

News |

PowerRating) being bid up to $92 based on being a “Harmon Pick for 2000.” USIT closed the year at 9/32 (that’s 28 cents).

The price targets. Stocks like

(

CMRC |

Quote |

Chart |

News |

PowerRating) and

(

QCOM |

Quote |

Chart |

News |

PowerRating) being given absurd price targets of $1000 and $800 per share. The absurd thing was these targets

were actually met! Let’s not forget the $1000 price target put on

(

QXLC |

Quote |

Chart |

News |

PowerRating) that propelled it to 117 3/8 after closing the prior day at $22.

Split runs. Remember the huge split runs we witnessed in the Internet sector? The list is too large to mention, but many tacked on over 100 points

into their respective split dates. Ahhh,.. memories.

Chat rats. The pubescent teens manipulating stocks through chat room postings and

bogus news reports. Millions upon millions were made and lost as a result of this deliberate criminal activity.

The “backdoor” IPO play. Stocks like

(

DBCC |

Quote |

Chart |

News |

PowerRating),

(

MALL |

Quote |

Chart |

News |

PowerRating),

(

DLIA |

Quote |

Chart |

News |

PowerRating) ,

(

XLA |

Quote |

Chart |

News |

PowerRating) all parent companies or owners of the mega-hyped “hot IPO.” All of these names were

eventually thrown out the backdoor.

“Penny stock” mania. This year also saw names like

(

EDIG |

Quote |

Chart |

News |

PowerRating) and

(

SSOL |

Quote |

Chart |

News |

PowerRating) rise from pennies to valuations in excess of $100. SSOL went from $.50 to $180 and

back down to close 2000 at $7. Whew, I hope no one actually sold at the highs–that would be a nasty tax bill.

Stocks popping 20 points on secondaries. Let me introduce those of you who bought these stocks to the term

“dilution.”

The $20 charge to mail a 40lb bag of dogfood from IPET. Hmm….

Please don’t squeeze the donuts.

(

KREM |

Quote |

Chart |

News |

PowerRating) squeezed shorts like Boston cream underfoot. Let’s not forget about the massive UBID squeeze up to $189 as

well.

Some of my personal heroes like Julian Robertson and George Soros calling it quits, citing insane market conditions. Mr. Soros actually was quoted as

saying, “The music has stopped but everyone is still dancing.” Chilling.

Stocks like Netzero and Efax basing their businesses on the concepts of giving away their services “for free.” I’ll get back to you later on that

one.

The IPO craze. Stocks running up to nosebleed valuations on hype and speculation only to crash down to earth. Anyone remember the hype on the

PALM IPO?

The Popping of the Internet bubble. Enough said.

Some analysts have referred to the sad fate suffered by the Nasdaq as “wringing out the

speculation.” Wow, that’s like saying that Boris Yeltsin enjoyed an after-dinner

aperitif from time to time.

My point in bringing up these events is not to remind us of pain or to give us a cheap laugh. But rather, to reinforce what our job as

“traders” really is: We are not “gamblers” and we don’t require a run-away bull market to

generate our income. If you consider yourself a professional trader (as you must by subscribing to a site like Trading Markets), you realize that this

is a profession that requires the utmost in education, training, research, discipline and dedication. By mastering the tools that are so widely

available to each of us now, we must constantly strive to become better and

wiser traders.

As Nietzsche once said “that which does not kill us makes us stronger.” If you had a great year, congratulations. If you didn’t, take the time to

learn from your mistakes and educate yourself properly so you are better equipped

to trade in 2001. In any environment, be it “up” or “down,” the

“professional daytrader” will thrive.

Have a happy New Year and a healthy and prosperous 2001.