Who Wants To Be A President?

Each morning this

list will contain those stocks with the potential to make a quick but tradable

move in the first hour. The information listed here is designed for the

trader who catches the early morning momentum, between the first five and 45

minutes of trading. Many stocks open each morning, run for several points and

then reverse. I will cover stocks with this potential and highlight possible

reversal points and resistance areas. These points need to be monitored closely,

as the stocks may turn quickly here. Be ready to lock in profits quickly.

Morning Outlook

Watch for a turnaround in the first 10-30

minutes of trading. Keep an eye on the stocks that gap the most in the morning.

Use the Nasdaq tracking stock (QQQ)

or futures as leading indicators.

Interestingly,

many of my trader friends told me that Wednesday was one of the hardest trading

days in the last few weeks. To be honest, the craziness resulting from the

fixation on the election makes me want to sit out a day. Of course, I probably

will not, but it is a novel idea. Yet, if you find that sitting out a day is

right for you, then go with it.

Two To

Watch:

(

PMCS |

Quote |

Chart |

News |

PowerRating),

(

BRCM |

Quote |

Chart |

News |

PowerRating),

(

JNPR |

Quote |

Chart |

News |

PowerRating)

It seems like

just yesterday, PMCS and BRCM were the talk of the town. It simply amazes me

how quickly things change.

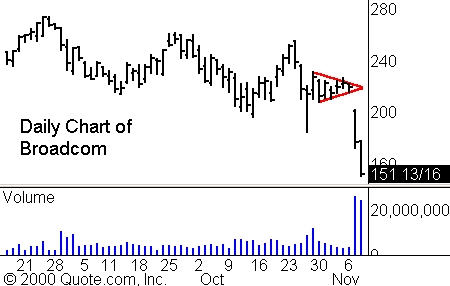

Broadcom

(

BRCM |

Quote |

Chart |

News |

PowerRating)

closed on its lows for the last two days after breaking down initially on

Tuesday from the pennant that it formed. And, not only did it trade

significantly lower, it did so on blow-out volume. With this type of momentum

behind the move, it is only appropriate to watch for a third continuation move.

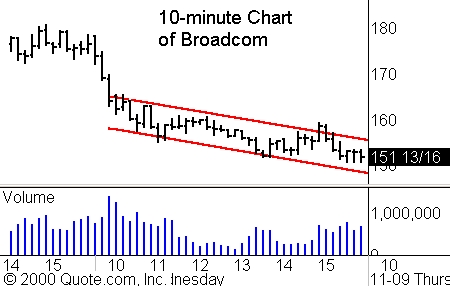

The 10-minute chart shows that there was minor support at 173 to

175 as well as near 160 and 150. The first two level listed are likely to act as

intraday pivot points.

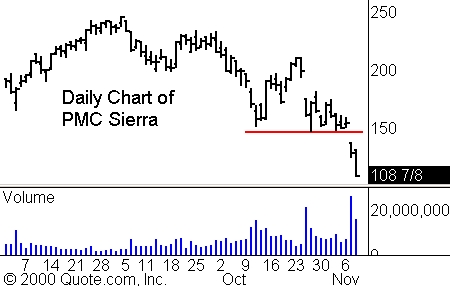

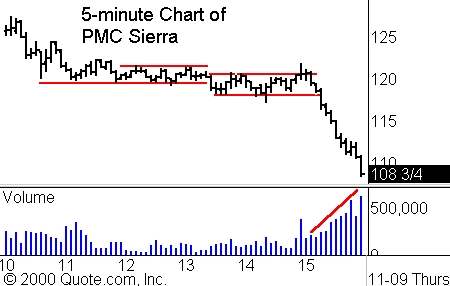

PMC Sierra

(

PMCS |

Quote |

Chart |

News |

PowerRating) looks quite similar to Broadcom — weakness

on strong volume.

More importantly, the five-minute chart shows even more

weakness. Particularly noteworthy is the accelerating volume at the close.

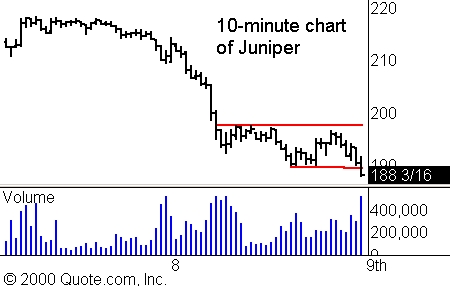

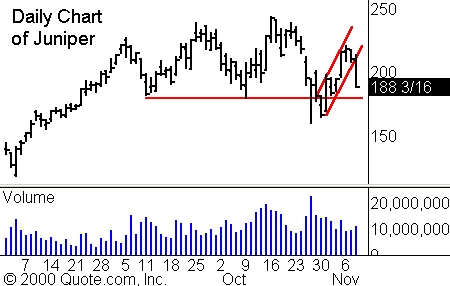

Lastly, I also have Juniper on the Baker Watchlist today. Will

the break of the mini-channel result in a test of support?

The 10-minute chart from Wednesday shows a breakdown at the

close on a volume surge.