4 Top Rated Tech Stocks for Traders:

What makes a tech stock a “top rated”?

How about a historical trend of being more than 8 times higher than the average stock in a week’s time?

Based on our research, which involved millions of simulated trades between 1995 and 2006, we found that there were certain stocks in certain conditions that, after five days, were likely to outperform the average stock. And not just outperform, but to do by significant margins.

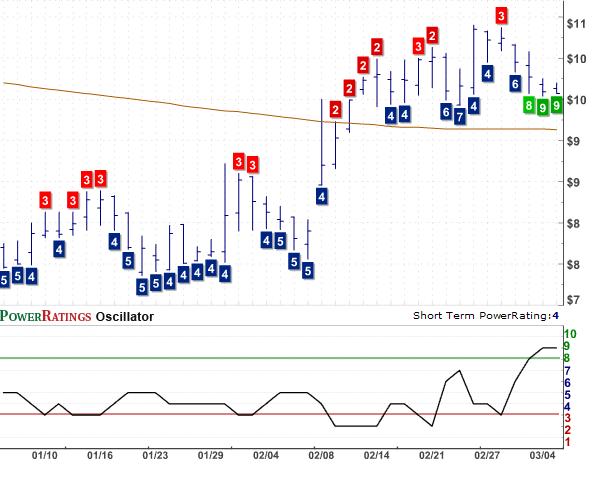

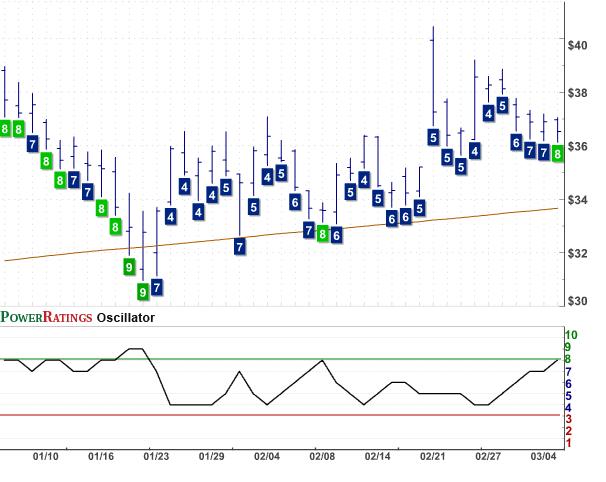

These conditions involved measurements of momentum, trend, volatility and volume. Those measurements allowed us to quantitatively rate stocks based on the likelihood of their outperformance in the short-term trader’s “sweet spot” of 5 to 8 days.

The best performing stocks were given ratings of 8, 9 or 10. The worst performing stocks–those stocks that were likely to underperform the average stock–received ratings of 3, 2 or 1.

These ratings, PowerRatings, provide short-term traders with an excellent tool both for selecting stocks for possible trades as well as a filter for potential trading opportunities produced from your own trading system.

Because traders are always looking at technology stocks, here are a sample of four of our “top rated” stocks in the technology sector. All of these stocks have Short Term PowerRatings of at least 8. According to our research, stocks with Short Term PowerRatings of 8 or better outperformed the average stock by more than 8 to 1 after five days.

Importantly, I have screened our high PowerRating technology stocks for one key factor: all of the four in today’s discussion are trading above their

200-day moving average. As Larry Connors, founder and CEO of TradingMarkets wrote late last year in a widely-circulated article, “5 Mistakes to Avoid in a Market Trading Below its 200-day Moving Average” traders need to stick to the strict discipline when the markets are under pressure. Part of that strict discipline includes only buying stocks that are above their 200-day moving averages, and only selling short stocks that are below their 200-day moving averages.

We have found that when the broader markets–the Dow Industrials, the S&P 500, the Nasdaq–are under their 200-day moving averages, there is no consistent edge in buying stocks that are also under their 200-day moving averages.

Let’s meet the stocks.

Photon Dynamics

(

PHTN |

Quote |

Chart |

News |

PowerRating) has a Short Term PowerRating of 9.

CyberSource

(

CYBS |

Quote |

Chart |

News |

PowerRating) has a Short Term PowerRating of 8

Cree Inc.

(

CREE |

Quote |

Chart |

News |

PowerRating) has a Short Term PowerRating of 8

ANSYS Inc.

(

ANSS |

Quote |

Chart |

News |

PowerRating) has a Short Term PowerRating of 8

David Penn is Senior Editor at TradingMarkets.com.