A Tale of Two Americas and 3 Short Term Investment Ideas

I have had the privilege of speaking with multiple famous and iconic players in the world of finance. One of my most memorable conversations was with the legendary commodity trader’s Jimmy Rogers. (Click here to read “A Conversation With The Legendary Jim Rogers”)

Several years ago, on the eve of the millennium, Rogers decided to drive around the world in a souped up, specialty built Mercedes Benz with his then girlfriend, Page. His goal was to see the entire world from ground level in search of the next hot market and/or investment. This inspired me greatly to the point of wanting to take my own journey to see America in the midst of potentially coming out of the economic crisis from a ground level.

Like a mini Jim Rogers’s adventure, I set off to circumnavigate the United States via automobile to observe first hand how America was coping with the radical sea change taking place between the East and West coasts. I saw many different situations and spoke with people on every step of the educational and economic ladder. Desert rat gold miners who shared their often harsh opinions on what’s wrong with America to the price of gold, a group of newly minted finance PhDs who were confident yet appeared nervous about the job market to small business people in the vacation spot of the Californian elite, Lake Tahoe who explained that this was their worse year ever.

Driving past multi million dollar second homes on ski slopes and perched preciously on the tip top of rocky ridgelines to burn out ghost towns outside of Reno, Nevada. Grabbing a burger at the filthiest McDonald’s I have ever seen to having to wait 4 hours for a table in Las Vegas, this journey has truly opened my mind about the 2 economies at work in this changing culture.

Las Vegas was packed with people spending money on expensive food, baubles and gambling yet the small business people seemed to be suffering in every town including towns populated by the wealthy and famous. The highly educated appear nervous about future prospects, while the desert rats keep pounding away at the desert sands, selling their gold for higher and higher prices. I will elaborate further on my opinion regarding this stratification of economic success in future articles. One thing remains a constant despite all the economic changes taking place and that is the need for short-term stock traders to locate companies ready to outperform. No matter how much the economy changes, there will always be those investments that outperform the others in the short-term. The dilemma was how to locate these stocks poised for gains.

We have developed an easy to use, yet highly effective method of locating these companies ready to pop higher regardless of the underlying economic situation. This article will explain each of the steps as well as provide 3 short-term investment names for your consideration.

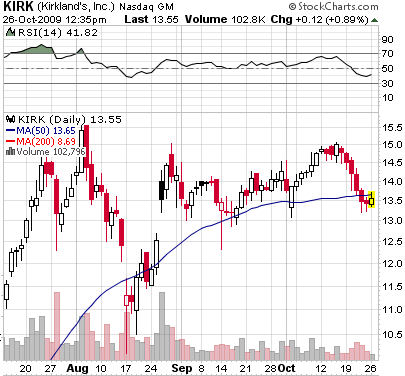

The first and most critical step is to only look at stocks trading above their 200-day simple moving average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (For additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short-term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short-term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names that fit the criteria for your consideration:

Clearwire Corp

(

CLWR |

Quote |

Chart |

News |

PowerRating)

Kirkland’s Inc

(

KIRK |

Quote |

Chart |

News |

PowerRating)

Rite Aid Corp

(

RAD |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.