BattlePlan Trade of the Week: Taking Profits on the Open in AVAV

We don’t spend a lot of time talking performance statistics when it comes to the TradingMarkets BattlePlan, our daily, pre-market subscription service for swing traders of stocks, options and exchange-traded funds.

One main reason is that while we provide specific entry and exit instructions for every single trade – as well as historical percentages to let traders know what the win-rate on any given trade has been in our backtesting – there is also a great deal of flexibility and customization that swing traders can bring to the Battleplan to suit their own personal trading style and risk factors.

Some traders want more trades – and are willing to accept more potential losing trades in exchange. Other traders want to buy only the deepest pullbacks and, as such, tend to take fewer trades – even if those trades tend to be more profitable.

That said, a question about today’s trade of the week came my way via e-mail this morning. So I thought it might be worthwhile to see just how traders who have been following the BattlePlan might be faring.

For the month of October, with one day remaining and one open position still in the model portfolio, we are profitable. In fact, a trader who allocated $5,000 to each trade in the BattlePlan for the month of October would be up more than $770 right now.

This monthly pace is consistent with what we saw in the previous quarter (July, August and September), where the same allocation would have a trader up by more than $2,000.

With a $50,000 trading portfolio (making each $5,000 trade 10% of the portfolio), this meant a 4% return for the third quarter.

What’s remarkable is that the vast majority of trades in the TradingMarkets BattlePlan have been long trades. The fact that we have been able to achieve these sorts of returns with a long bias in a quarter when the S&P 500, for example, fell more than 8%, is pretty impressive. Include the month of October and the performance of the BattlePlan compared to the performance of the S&P 500 is all the more worth noting.

Our BattlePlan trade of the week this week was in Aerovironment Inc.

(

AVAV |

Quote |

Chart |

News |

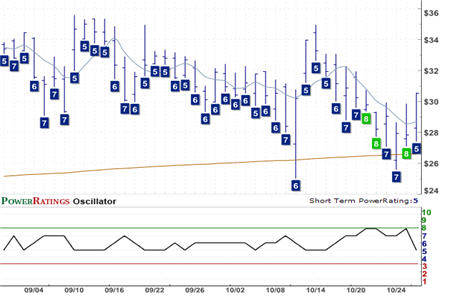

PowerRating). We picked up shares of AVAV back on October 22, the morning after the stock earned a Short Term PowerRating of 8 and a 2-period RSI of 6.50.

The stock closed higher over the next four days, even after dipping below the 200-day moving average on an intraday basis. But it was not until the 28th that AVAV soared above its 5-day moving average – our exit signal – closing more than 4% above our entry price. What’s more, traders who exited not on the close but on or shortly after the open on the 29th benefited from a gap up that saw AVAV open at 31.88 – more than 9% above our entry price.

Of course, not every trade will work out as well as AVAV did. And we can’t guarantee that the success we have had in the TradingMarkets BattlePlan will reflect future results – certainly not in a market as complicated and volatile as this one.

But what we can guarantee is incisive, before-the-bell commentary and analysis on the day’s markets to help put your trading in context. We’ll give you suggested entries and exits for trade opportunities that may be only hours away. And we’ll give you what many other people can’t: model-driven percentages so that you know the historical win rate going back to 1995 for every single trade idea – long and short.

Give the TradingMarkets Battle Plan a read before the next market open. Click here to start your subscription or call us today at 888-484-8220. Come see what the TradingMarkets approach to trading can do for you.

David Penn is Editor in Chief at TradingMarkets.com.