A Method for Scaling-in to a Trade

Adding to a Position.

With this I am continuing the series of the articles dedicated to the practical aspects of Trading and useful tools that can be used in Day Trading.

In this article we will cover a topic of maximizing our profit by adding to our existing Position. What we mean by “Adding to a Position” is an increase of the size of the Position. In other words we will be Buying or Selling Short more shares increasing the number of the shares we trade in a particular Position. This approach helps us to increase our profits.

So let’s see how it works on practice.

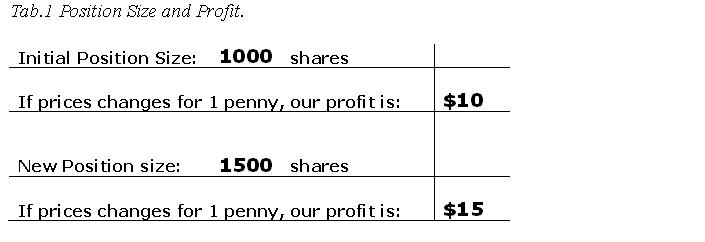

Let’s assume that we have an open Position of 1000 shares. This Position is already profitable which means that we are sitting “In-The-Money” and have Unrealized Profit. Let’s say that somehow we figured out that the stock price will go further in the direction that we need. Now we can increase our Position to 1500 shares, for example.

After the increase of the Position size, our Average Price will be different from our initial purchase price; however the size of the Position is greater, meaning that now for every penny of the price movement we get a greater reward.

Please look at the tab below to understand the difference.

The next question we need to answer is, “How do we determine a Price or Level at which we add to a Position?”

The answer is very simple: we need to use the same rules that we use when we open an initial Position. It can be related to Volume, Support or Resistance Levels or to other Trading Strategies.

This is a simple technique that can help you to increase your profit greatly!

Happy Trading!

Roman Larionov is the founder of the Absolute Resolution Project, managed by the Absolute Resolution Consultants – New York based consulting company established in 2007. He has 12 years of experience including senior and executive management positions, project management, revenue management, sales, product development, people management and customer service. His trading experience includes 8 years of trading FOREX and NYSE equities.

Mr. Larionov holds two Bachelor’s Degrees in Management and Management of Crisis Situations along with the MBA degree in International Business.

Just released! Leveraged ETF PowerRatings ranks Leveraged ETFs on a high probability 1-10 ratings scale. Click here to get your free trial now.