A Miracle Indicator & 5 Stocks Ready To Rock

Traders and investors are constantly on the hunt for the next big technical indicator. Finding an indicator that actually places the odds of short term success firmly on the trader’s side is similar to the search for the Holy Grail. Everyone is always close to finding it, but no one actually does.

Most investors bounce from one idea to the next, never really quantifying or testing the concepts first. They think if it’s in a book, it has got to work. Nothing could be further from the truth. Most trading books are simply repeats of others touting the same old untested tactics and psychological babble. Very few actually contain quantified, tested tactics that will actually help your short term investing. One of the exceptions to this rule is Larry Connors’ “Short Term Trading Strategies That Work“. This is where I first learned of the miracle indicator.

Of course, no indicator is fool proof 100% of the time. However, this tweaked version of the Relative Strength Index comes as close to the Holy Grail than any other that I have seen.

Most traders and short term investors are familiar with the Relative Strength Index or RSI. It is an oscillating indicator first popularized by Welles Wilder in his 1978 book, “New Concepts in Technical Trading Systems“. It is used to locate stocks that are overbought or oversold by comparing increasing price moves to decreasing price moves over a specific time frame. RSI is built into many trading/charting platforms with the Welles Wilder standard setting of 14 periods as the default. It is scaled on a chart from 0 to 100. Readings below 30 are believed to indicate an oversold condition; those above 70 are thought to indicate an overbought condition.

What was discovered in Larry’s book via extensive tweaking and testing is that if you reduce the periods to 2 in the RSI, a true edge exists in using it. The testing was done by building a benchmark of the average percentage gain/loss of all stocks, trading above their 200-day Simple Moving Average, over a 1 day, 2 day, and 1 week timeframe. What was statistically proven was that the lower the 2-period RSI, the better the performance against the benchmark. In addition, the opposite also proved to be true. The higher RSI(2), the higher the underperformance against the benchmark.

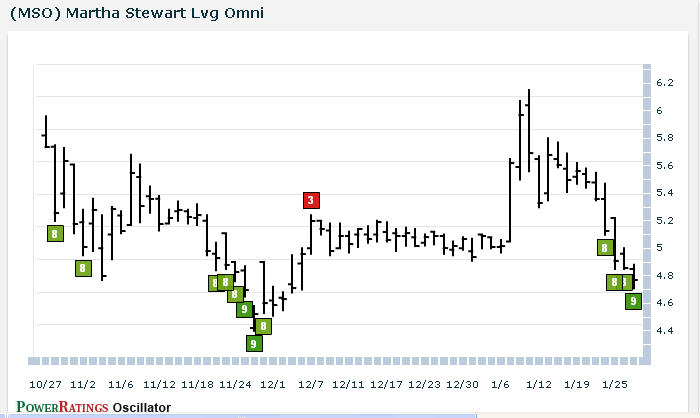

How can this information be put to practical use to help your short term investing? Simply put, only look at stocks with an RSI(2) of 2 or less for short term longs. If you are seeking companies to short, apply the opposite logic by only considering shares with an RSI(2) reading of 98 or above.

Here are 5 PowerRatings stocks with RSI(2) less than 2 for your consideration:

^CPLP^

^CYCC^

^DRH^

^HOGS^

^MSO^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.