A New Way of Trading Volatility

The CBOE Volatility Index (VIX) measures market expectations of near-term

volatility. This is achieved by estimating expected volatility from S&P 500

stock index options in a wide range of strike prices.

The VIX was launched in 1993 and has long been considered the benchmark for

measuring market volatility. Over the years, the VIX has undergone some changes

but the concept remains the same. It is a real-time view of expected stock

market volatility over the next 30-days.

It is often referred to as the “fear index†as market volatility usually

rises during times of financial stress, as witnessed recently when credit-market

turmoil spread to the stock market. Option prices, and the VIX, tend to rise

when the stock market declines. As the stock market stabilizes, option prices,

and the VIX decline. This action represents the level of fear investors feel,

which tends to rise and fall with the stock market.

As mentioned earlier, the VIX has undergone some changes. The most notable

one took place in 2003, and was implemented in 2004.* The VIX methodology was

changed, resulting in three important differences:

- The New VIX is calculated using a wide range of strike prices in order to

incorporate information from the volatility skew. The original VIX used only

at-the-money options. - The New VIX uses a newly developed formula to derive expected volatility

directly from the prices of a weighted strip of options. The original VIX

extracted implied volatility from an option-pricing model. - The New VIX uses options on the S&P 500 Index, which is the primary U.S.

stock market benchmark. The original VIX was based on S&P 100 Index (OEX)

option prices.

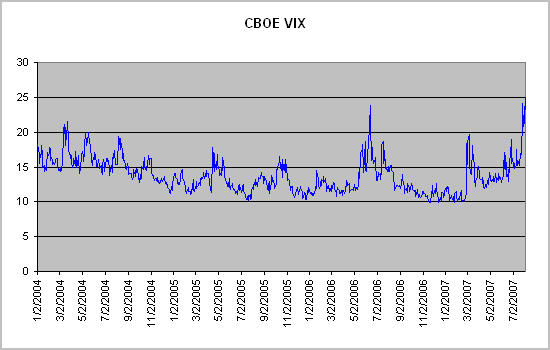

The chart below is the complete closing price history for the VIX, using the

new methodology. The chart shows that Friday, August 3, was the highest closing

price since the changes were made.

Trading the VIX

On March 26, 2004, the CBOE Futures Exchange (CFE) launched VIX Index

futures. Then, on February 24, 2006, the CBOE launched VIX Index options.

Options on VIX will have a multiplier of $100, and will have contract months

of two near-term contract months plus one additional month on the February

quarterly cycle. Trading hours will be 8:30 a.m. to 3:15 p.m. (Chicago Time).

The options will be European-style exercise, and will be cash settled.*

VIX Index options have gone on to become very popular, recently setting a new

daily volume record.

Longtime TradingMarkets members and readers will know that we have been using

VIX trading strategies for many years. In fact, Larry Connors was among the

first traders to publish research on the VIX. This research led to the creation

of a number of CVR signals (Connors VIX Reversal), many of which we still use

today. TradingMarkets members can access daily CVR signals in the

Market Bias section of the stock indicators. This section of the

TradingMarkets site is the ideal place to start planning for the upcoming

trading day. If you don’t have a TradingMarkets subscription,

click here to start your 7-day free trial.

This experience gives us, and our customers, a tremendous advantage in

building successful VIX trading strategies. We have been trading many of these

strategies with real money for more than a decade. The creation of VIX options

allows us to expand these strategies and tailor them specifically to focus on

trading the VIX itself.

Over the coming weeks we will be publishing a number of new VIX trading

strategies. These strategies have never been seen before and have some of the

best performance statistics we’ve ever published. We’re very excited about this

research and look forward to sharing it with you.

TradingMarkets members can access a number of articles previously published

articles by Larry Connors on the VIX in the

Learning Center.

Sign-up now for a no obligation, 7-day Free Trial to receive unrestricted

access.

*This information comes directly from the

CBOE website.