Are Analysts’ Estimates Important to Stock Prices? – Part 1

I get emails from investors all the time asking why some stocks with declining earnings will gain in value following their earnings announcement despite the fact that the news sounds “bad”.

Usually the response I give is the same one reported in the news that despite the decline it was not as bad as “estimates” and therefore the stock has been discounted too much and will rise in value.

That response sounds reasonable but it leads to the question of where do these estimates come from? They come from stock analysts who issue forward looking estimates or forecasts about what a stock is likely to do in the future both in terms of stock price and the underlying financial fundamentals.

Stock analysts typically work for investment banks or brokerages and although they are supposed to be independent of the investment banking services and sales organizations they rarely are. It is very common for an investment bank that is underwriting and/or investing in a public company to also be issuing “unbiased” analyst reports on the same firm. This common problem throws some doubt on the neutrality of these reports.

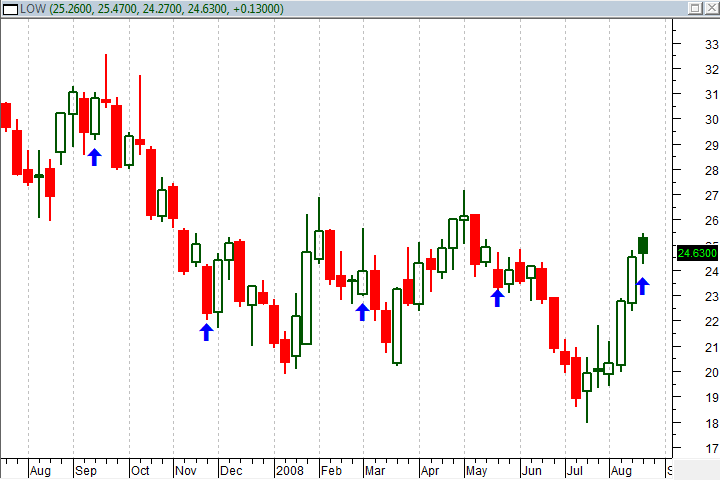

Most large stocks have more that one analyst/bank issuing reports and estimates on the company. Although analysts are notoriously bullish on everything they cover, the coverage can still be a source of interesting information. The reports are easy to access through information service providers like Reuters, Thompson or Bloomberg who will compile several analyst reports into summary information that is frequently republished on major financial portals like Yahoo! Finance or Google Finance. Those average ratings and estimates are what the media will most often point to as “market expectations.” For example, LOW estimates for earnings were $0.51 a share before the release today but actual earnings only dropped to $0.64 per share. That difference was a positive earnings surprise and is considered bullish. The estimates number will vary depending on which analysts were surveyed and who is reporting the composite or average rating but most average reports will show that LOW did exceed estimates.

alt=”LOW Chart” pbsrc=”https://tradingmarkets.com/media/2008/HowTo/0827Jagerson2.png” pbCaption=”” onclick=”Pop(this,50,’PopBoxImageLarge’);” width=”550″ height=”350″ class=”PopBoxImageSmall” title=”Click to magnify/shrink” />

alt=”LOW Chart” pbsrc=”https://tradingmarkets.com/media/2008/HowTo/0827Jagerson2.png” pbCaption=”” onclick=”Pop(this,50,’PopBoxImageLarge’);” width=”550″ height=”350″ class=”PopBoxImageSmall” title=”Click to magnify/shrink” />

Do analyst estimates matter to the stock long term or is it merely a convenient explanation for short term volatility? I would argue that analysts estimates have little if any affect on a stock’s performance or even the market at large in the long term. For example, LOW has positively surprised analysts in its last 4 quarterly reports and you can see (in the chart below) that after an initial bump the stock retraced to follow the general market trend to the downside. This situation is typical of most large stocks and it is a great example of why diversification is so important. Traders can easily be shaken by missed or exceeded earnings reports into getting out too early despite the fact that these reports have little predictive value. Holding a broader, diversified-portfolio of stocks helps smooth these price shocks out.

Analysts do have some redeeming value as well. In part-two of this article I will show you how to access analyst reports and more importantly how to listen to analysts quiz a company’s management team during each quarter’s earnings calls. These calls are more spontaneous than the analyst reports and good information about a company’s prospects, strategy and competitive environment is frequently heard.

In part 2, John Jagerson shows you how a company’s management team is quizzed by analysts during quarterly earnings calls. To read Part 2 of our series on analysts’ estimates, Click Here.

John Jagerson is the author of many investing books and is a co-founder of LearningMarkets.com and ProfitingWithForex.com. His articles are regularly featured on online investing publications across the web.