Are you long energy? Here’s what to do

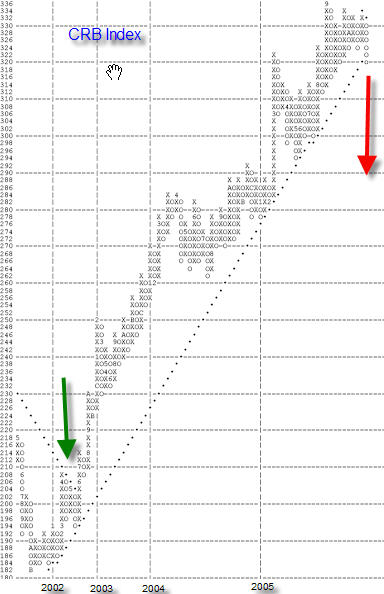

The Reuters Jeffries CRB Index has broken through

its bullish support line on an intraday basis. This breakdown adds insult to

injury due to the fact that the index has also been trading below its 50-day

simple moving average.

The support line that was violated has been in

place since June of 2002; therefore, this break is major. For added

confirmation, conservative traders may like to see a close below the violation

point before acting on the breakdown (a close at 320, and then 318 for added

confirmation). I also see this as a major blow to the energy stocks that I have

been (up until now) quite bullish about.

In addition to this development, the relative

strength chart that I referenced in my last column, of the Morgan Stanley US

Investable Market Energy Index

(

MSCIEN |

Quote |

Chart |

News |

PowerRating) versus the Equal Weighted S&P 500

Index, has rolled to Os, or is now in a declining trend (for those of you

unfamiliar with the point and figure method).

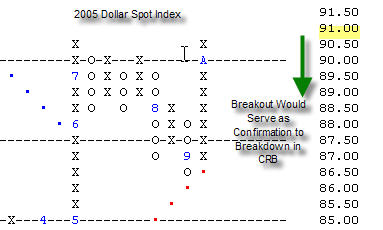

In conjunction with the breakdown in the CRB

Index, we have also seen a rise in the dollar. For those unaware of inter market

relationships, a rising dollar is generally deflationary. The dollar is now at a

similar point of resistance as it was in July of this year. If the dollar spot

index can break to $91.00, that will be an added confirmation that the “bloom is

off the rose†for commodities.

What should you do? If you haven’t sold any of your oil stocks, evaluate which

ones to sell. I wouldn’t sell all of your holdings in the sector, but reduce

exposure significantly. I do not recommend any additional purchases in that

sector at this time either.

As for stocks in the metals sector, I recommend

also evaluating those on a case-by-case basis to determine future price

appreciation or depreciation as the case may be. For stock investors, what could

be a good strategy for those funds that were formally invested in energy or

metal type stocks? At this very moment, I am recommending cash. Until we can get

some leadership from any one particular sector, cash should be fine to hold.

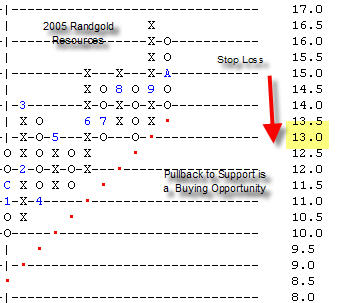

In thinking about leadership, gold has been

strong on a technical basis. However, I do not recommend overweighting the

sector due to the fact that gold normally moves opposite the dollar and WITH

commodities (it is one, after all). If you don’t have any exposure, you could

purchase a small piece of Randgold Resources Limited

(

GOLD |

Quote |

Chart |

News |

PowerRating). The stock has

pulled right back to support and is very close to its stop at $12.50. This trade

would again be for aggressive investors as its momentum is negative and it is

trading below its 50-day simple moving average. More conservative investors

could wait for a close above the 50-day simple moving average and a turn to

positive on momentum. If you have gold exposure, just sit on the sidelines here

with your cash until we can get some more clearly defined and broader based

leadership.

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.