Base Metals in Free Fall: How to Profit

In addition, the weakening of the U.S. Dollar increases investment interest in the suite of base and precious metals adding fuel to the metal fire. However, signs are that this may be quickly changing. Copper has fallen to a 6 month low in London trading, aluminum is retreating to a 4th weekly loss in a row and zinc recently hit a 2 year low. Weaker demand in industrialized nations and a surprisingly stronger U.S. Dollar appears to the primary culprits causing the pullback.

However, emerging markets still seem to be supporting prices and balancing the demand decline when you look at the growth picture of these fledging economies. Coppers open interest has spiked 3.8% in July, this normally is a sign of increasing short positions or commercial hedgers protecting themselves against lower prices.

Will the market for these critical metals continue to weaken or is a new bull run right around the corner?

Regardless of your bias, there are option strategies to best reflect what you believe is going to happen in the near future. I believe the Invesco Power Shares Base Metal Fund

(

DBB |

Quote |

Chart |

News |

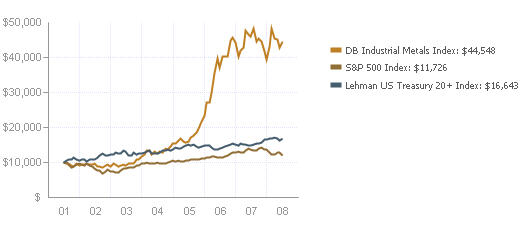

PowerRating) is an excellent proxy to trading the futures directly. It represents the movement of an index that is directly tied to aluminum, copper and zinc prices. The performance has been impressive over the last 7 years but the party may be coming to an end.

Here are 3 options strategies to best represent your views on the future direction of the base metals. Remember we are assuming a month time horizon and $ 2000.00 of risk capital on the trade.

Bearish

A Put Back Spread makes sense, here are the mechanics:

Buy 20 January 2009 20 Puts DBBMT at $1.35

Sell 10 January 2009 21 Puts DBBMU at $1.75

Your break even point is $18.05 and trade has a total risk of $1950.00

Neutral

A Long Straddle is what a neutral biased trader should consider. Here is a current example of one:

Buy 3 January 2009 23 Calls DBBAW at $2.10

Buy 3 January 2009 23 Puts DBBMW at $3.50

Break even is $17.40 and $28.60. A total risk of $1680.00 and gains are theoretically unlimited

Bullish

Bullish Call Spreads look sweet here if you’re bullish. Here is how one looks right now:

Buy 7 January 2009 20 Calls DBBAT at $3.90

Sell 7 January 2009 26 Calls DBBAZ at $1.15

Break even is $22.75 and there is a maximum risk of $1925.00.

Remember, risk is an inherent part of option trading. No matter how sure you are about the strategy, always only use risk capital and position size properly.

Best Wishes!

David Goodboy is Vice President of Marketing for a New York City based multi-strategy fund.