Battle Plan Trade of the Week: Full TLT Trading in Bond ETFs

For the past several days, I have been beating the drum in Short Term PowerRatings articles, letting stock and ETF traders know about the potential, short term opportunities for a bounce in the increasingly-oversold market for bond ETFs.

From my “PowerRatings, ETF Trading and Bonds on Sale” to, most recently, my report “PowerRatings, Overbought Stocks and the Bond Bounce,” it was clear that the rising Short Term PowerRatings in bond ETFs like LQD, AGG and TLT were making these funds more and more attractive to short term traders looking to buy low and sell high.

The TradingMarkets Battle Plan, our subscription service for stock and ETF traders, spotted a particular opportunity in one ETF, the iShares Barclay’s 20-Year Treasury Bond ETF, TLT

(

TLT |

Quote |

Chart |

News |

PowerRating), early in the week after the fund’s Short Term PowerRating had fallen from a four several days previously to an eight.

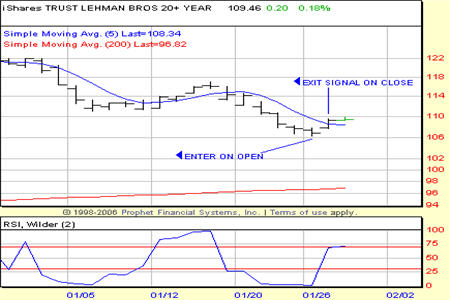

We managed to catch TLT at what turned out to be the ETF’s low point. We were attracted to TLT not just because of its high Short Term PowerRating, but also because of the ETF’s extremely low 2-period RSI of less than 1.

Consider this: our research has noted that ETFs, which tend to be less volatile than stocks, are oversold when their 2-period RSIs are below 30 or 40. Stocks, by contrast, are considered to be extremely oversold when their 2-period RSI falls below 2. So to encounter an ETF with a 2-period RSI of less than 1 is to find market that is supersaturated with sellers. These are the kind of markets we want to be buying in. As one trader recently explained to me in an interview: “I like to sell to buyers and buy from sellers.” We couldn’t agree more.

Long TLT on January 26, we waited for a sign of strength in order to exit (remember: having bought from sellers, we now wanted to sell to buyers). That sign came in the form of a close above the 5-day moving average only a day later on January 27. We were able to exit TLT nearly two points higher.

These are the sort of short term, high probability stock and ETF trades that we look for every day in the TradingMarkets Battle Plan. While some trades may yield even greater short term returns — and some trades not work out as well as planned — traders who use the Battle Plan know that every day they are working with a quantified, backtested strategy for spotting high probability opportunities for short term trades in stocks and ETFs.

Give the TradingMarkets Battle Plan a read before the next market open. Click here to start your subscription or call us today at 888-484-8220. Come see what the TradingMarkets approach to trading can do for you.

David Penn is Editor in Chief at TradingMarkets.com.