Better Action Of This Week Needs To Continue

The

action of this last week was substantially improved from the prior

week. We had some close calls on both the

long and the short side, and anxious traders might even have taken a long or

two, though they did not quite meet ALL of our criteria.

Our finger remains on the trigger, ready to pounce on any real

opportunities, but the market needs to continue to build on last week’s better

action in the weeks ahead before we can get excited about a good environment.

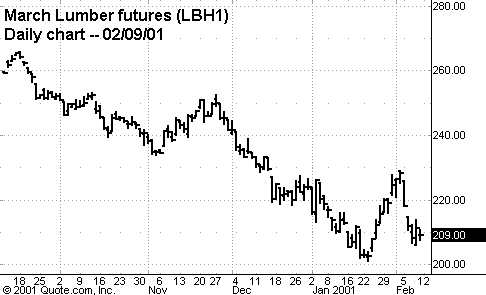

The

bond, crude oil and lumber markets are also troubling from a macro-view

perspective. Lumber rallied to its first

resistance zone and has turned around hard and is close to retesting its lows.

This might turn constructive if it can trace out a major bottoming

formation like a double-bottom or head-and-shoulders bottom.

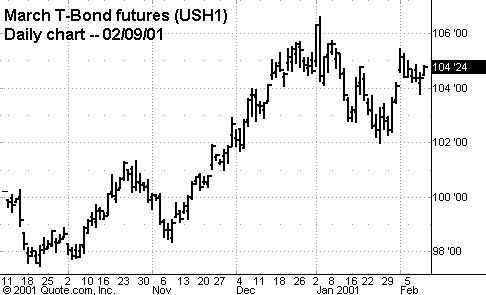

Bonds reacted lower off of initial rate cuts, but acted surprisingly

positive off of the latest rate cut. It

appears bond holders do not yet believe that the Fed has lowered rates enough to

reverse the economic contraction. When

bonds turn lower, possibly very soon, and break below last week’s lows, it will

be a more encouraging sign economically. In

this disinflationary to deflationary world, higher crude oil prices do not mean

higher inflation. They mean the same as monetary tightening.

Higher prices cannot be passed on to consumers in this intensely

competitive global marketplace, so they simply cut into both corporate profit

rates and into consumers’ buying power. It

would be nice if crude held below the highs of Oct.-Nov. of last year.

New highs in crude make the Fed’s work of re-stimulating the economy

tougher.

Â

Created with Realtick III by Townsend Analytics

The

bottom line is that we continue to advise WAITING FOR A LARGER NUMBER OF VALID

BREAKOUTS IN STOCKS MEETING, OR VERY CLOSE TO MEETING, ALL OF OUR FUEL CRITERIA,

AS WELL AS CLEAR LEADERSHIP BY SOME GROUPS CONSISTENTLY ON OUR DAILY TOP RS/EPS

NEW HIGH LIST BEFORE BUYING WITH BOTH HANDS IN THIS MARKET.

Keep your finger on the trigger, but don’t shoot until you see an

abundance of valid breakouts of up-fuel stocks. We’re

getting close, but we’re not quite there.

Let’s

look at some numbers from the week. New

Highs vs. New

Lows on our RS/EPS lists were 26/0, 28/4, 24/5, 30/2 and 29/6.

New lows remain all but non-existent. There

were roughly 18 breakouts on the upside (a good environment will show five times

this number or more) with four breakdowns on the downside of four-week plus

consolidations on our RS/EPS lists. However,

most importantly, there were no valid breakouts on the upside in up-fuel stocks,

and no valid breakdowns on the downside in down-fuel stocks.

This week did show an increase in the number of breakouts that were CLOSE

to meeting our up-fuel criteria and even closer to meeting our down-fuel

criteria. Remember that many close calls

in either direction is a plus and the fact that they both occurred in tandem

this week does not detract from the long-side case in any way.

This past week we had valid breakouts in stocks very close to meeting all

of our criteria in Gildan Activewear

(

GIL |

Quote |

Chart |

News |

PowerRating) (debt was just a little higher

than our criteria) and in Standard Pacific

(

SPF |

Quote |

Chart |

News |

PowerRating) (also high debt), but

anxious traders may have taken some small-scale positions in these.(

RCII |

Quote |

Chart |

News |

PowerRating)

(debt, funds and group were problem) and ENI

(

E |

Quote |

Chart |

News |

PowerRating) (volume on breakout and group

were a problem). On the downside, we had

some close calls for the first time in many months in CacheFlow

(

CFLO |

Quote |

Chart |

News |

PowerRating),

American Superconductor

(

AMSC |

Quote |

Chart |

News |

PowerRating) and Sepracor

(

SEPR |

Quote |

Chart |

News |

PowerRating) (all of which did

not show sufficient volume on the day of the breakout). But we

continue to wait patiently for highly reliable trades to show up.

We’re just not quite there yet.

Our

overall allocation is now 100% in T-bills awaiting new opportunities for the

first time since 1998. Our model

portfolio followed up weekly in this column ended 2000 with about an 82% gain on

a 12% maximum drawdown, following a gain of around 41% the prior year.

For the year 2001, we are now down about 1.54%, with a full cash

position.  Â

For

those not familiar with our long/short strategies, we suggest you review my

10-week trading course on TradingMarkets.com, as well as in my book The

Hedge Fund Edge and course “The

Science of Trading.” Basically,

we have rigorous criteria for potential long stocks that we call “up-fuel,”

as well as rigorous criteria for potential short stocks that we call “down-fuel.”Â

Each day we review the list of new highs on our “Top RS and EPS New

High list” published on TradingMarkets.com for breakouts of four-week or

longer flags, or of valid cup-and-handles of more than four weeks.

Buy trades are taken only on valid breakouts of stocks that also meet our

up-fuel criteria. Shorts are similarly

taken only in stocks meeting our down-fuel criteria that have valid breakdowns

of 4-plus-week flags or cup-and-handles on the downside.

We continue to buy new signals and sell short new short signals until our

portfolio is 100% long and 100% short (less aggressive investors stop at 50%

long and 50% short). In early March we

took half profits on nearly all positions and lightened up considerably as a

sea-change in the new economy/old economy theme appeared to be upon us.Upside

breakouts meeting up-fuel criteria (and still open positions) so far this year

are: none; and last week we had no valid

pattern breakouts up in stocks meeting our up-fuel criteria (see 10-week trading

course). Continue to watch our NH list

and buy flags or cup-and-handle breakouts in NH’s meeting our up-fuel criteria —

but continue to add just two per week.

On

the downside, this year we’ve had breakdowns from flags (one can use a down

cup-and-handle here as well) in stocks meeting our down-fuel criteria (and still

open positions) in: no open positions at

the moment; and this last week we had no

valid pattern breakdowns in stocks meeting our down-fuel criteria (see 10-week

trading course). Continue to watch our NL

list daily and to short any stock meeting our down-fuel criteria (see 10-week

trading course) breaking down out of a downward flag or down cup-and-handle.

Here, too, remain cautious by only adding two shorts in a week.At

this point our strategy is simple, but for many traders it is the most difficult

possible environment. Remember that there

are at least two times that losses mount to defend portfolios against.

The worst is a highly negative environment.

We’ve done well at avoiding anything but gains in the swift bear market

of 2000. The

reason we wait so patiently for high-reward reliable trades that meet all of our

criteria, or at least a market that gives an abundant supply of opportunities

inches from meeting all of our criteria, is to avoid both the negative and

whipsaw environments as much as possible. Sometimes

this may delay us from getting into to a new bull or bear market.

But we can more than make up for delays with our stock-picking

methodologies. We don’t strive to pick

the bottom or the top of any market environment.

We strive to make consistent better-than-market returns with relatively

little risk. So we must now simply wait

for valid breakouts of valid up-fuel stocks for opportunities.

When such opportunities become abundant, pounce with both hands.

Until then, tread cautiously. Even

if this is just another bear-market rally, we should get some trading

opportunities soon if the rally has any real teeth.

It may take another rate cut on March 20 before real teeth develop. We’ll

see.