Bull Tools: How to Make the Most of the Pullback

Despite the raging bull market, this is one fickle environment to trade. News and event traders have got to be shaking in their boots as it clearly seems that price is driving news and not the other way around.

In other words, when the market drops the media looks for ways to present the news in a negative way. When the market climbs, similar news is presented in the most positive manner possible. While this is obviously not the case in all situations, it truly appears to be the dominate force presently. While there are arguments for and against the above observation, the markets’ behavior itself has not changed in the slightest. Markets never go straight up, pullbacks and weakness is bought, and they are in a constant state of ebb & flow. The smart money waits for a bargain then pounces when the time is right sending price higher once again.

We conducted extensive research to quantify this buying the dips observation so that it could be used to provide a trading edge. What we found was quite astonishing. Here is the results of the study, remember, all the names were trading above their 200-day Simple Moving Average.Â

Stocks that closed down exactly three consecutive days, on average, outperformed the benchmark 1-week later (+0.36%).

Stocks that closed down exactly four consecutive days, on average, outperformed the benchmark 1-week later (+0.54%).

Stocks that closed down exactly five consecutive days, on average, outperformed the benchmark 1-week later (+0.63%).

Stocks that closed down exactly six consecutive days, on average, outperformed the benchmark 1-week later (+0.82%).

Stocks that closed down exactly seven consecutive days, on average, outperformed the benchmark 1-week later (+1.06%).

As you can see, there is significant edge in buying stocks that have fallen 5 or more days in a row. The odds become even greater for a short-term bounce when you combine PowerRatings greater than 8 and a RSI(2) lower than 2.

Here are 3 stocks that may help you make the most of the pullback:

Vonage

(

VG |

Quote |

Chart |

News |

PowerRating)

Zumiez

(

ZUMZ |

Quote |

Chart |

News |

PowerRating)

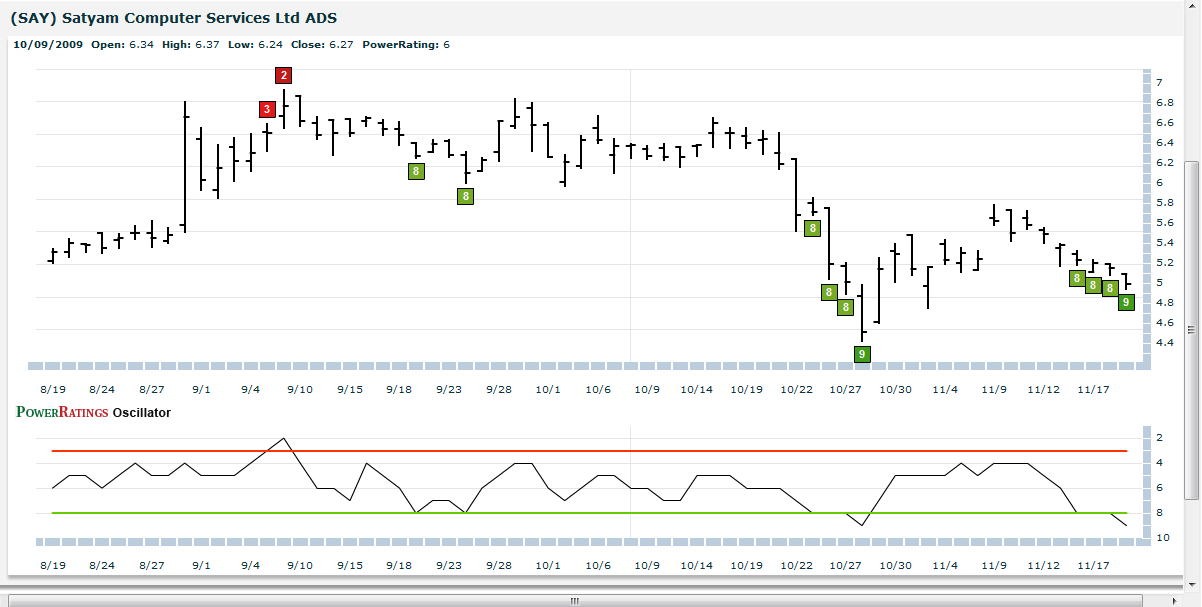

Satyam Computer

(

SAY |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.