Connors Research Traders Journal (Volume 30): A Counter-Intuitive Strategy To Predict The Direction of the VIX

Since the early 1990’s when the VIX was launched, traders and researchers have debated whether or not the VIX predicted the direction on the S&P. We’ve shown in numerous studies, both on a short-term basis to as long as a 12-month basis that when done correctly it does.

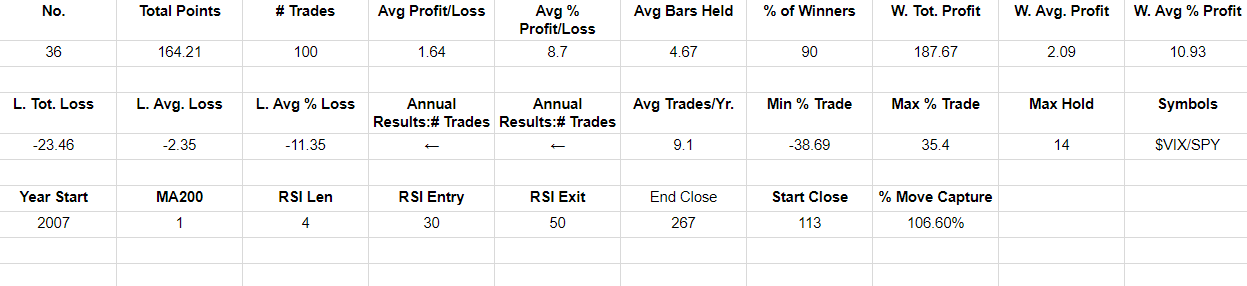

While we were doing new VIX research recently, we came across some interesting test results. The test results show evidence that SPY does a very good job of predicting the direction of VIX.

Here are the rules on the test that led to this conclusion:

1. SPY is above its 200-day moving average

2. The 4 period RSI of SPY is below 30

3. Sell VIX (I’ll explain how in a minute)

4. Buy VIX back when the 4-period RSI of SPY is above 50.

As you can see for over the past decade when the above conditions in SPY have existed, VIX has declined exactly 90% of the time on average in under a week. Having researched and tested VIX since 1995, these results somewhat surprised me. I knew VIX led SPY and the correlation was fairly high. I didn’t know that SPY led the value of VIX on such a high percentage of the times and to its extent.

We’re going to go further with this research. In the meantime, one of the ways to trade these directional edges is with VIX options. This can be done with ITM puts and with various VIX credit spread positions that can take advantage of both price and time. The VI options reflect the pricing of the VIX futures. not the VIX index itself so you’ll want to take that into account. But, anything that has accurately predicted the direction 90% of the time for over a decade can have trades constructed around it in order to take advantage of those large directional biases.

Larry Connors