Connors Research Traders Journal: Making Money From The Behavioral Mistakes of Others – “Loss Aversion”

Why do many investors, from amateur to seasoned professionals, routinely hold onto their losing trades for too long and sell their winning trades too quickly?

How does this well-known investor behavior affect market prices? How can you take advantage of this to profit in the marketplace?

Keep reading to find out.

In this article, I am going to focus on a common behavioral bias known as “loss aversion”.

Why do you care?

Because loss aversion has a large impact on market prices. You can then use this knowledge to potentially profit from the behavioral missteps of others!

What Is Loss Aversion?

Losses loom larger than corresponding gains.

-Daniel Kahneman

Loss aversion is the tendency for people to prefer avoiding losses to acquiring equivalent gains.

Losses feel much worse than gains feel good. This difference causes traders and investors to act differently to avoid a loss. It is stated that, psychologically, the pain of losing feels nearly twice as bad as the pleasure of gaining.

I know many professional traders. They include many of the traders who have been interviewed in Jack Schwager’s classic series “Market Wizards.”

Even though these traders applied different trading styles, had different upbringings, and many are as different as night and day, they all share one thing in common. They rarely, if ever, talk about their winning trades – they do though dwell on their losing trades.

Think about this. As a whole, these traders have had great success; many for decades. Yet, they better remember their losing trades, not their winning trades. The pain of losing is far greater than the joy of winning.

You can always tell a professional trader from those who claim to trade. The professionals talk a lot about their losing trades. The amateurs only talk about their supposed winning trades.

Because the pain of losing is greater than the joy of winning is universal, this often leads to irrational behavior as people try to avoid losing. This has been proven over and over again. Here’s an example…

Nobel Prize Winner Daniel Kahneman and Prospect Theory

Loss aversion is a central theme in Daniel Kahneman and Amos Tversky’s seminal 1979 paper – “Prospect Theory: An Analysis of Decision under Risk.”

What Kahneman and Tversky found, simply stated, was that subjects display risk-averse behavior in choices involving sure gains and display risk-seeking behavior in choices involving sure losses.

This risk-seeking behavior, when a sure loss is on the table, stems from the desire to avoid the loss (in this case avoiding the sure loss).

Kahneman and Tversky conducted several experiments in the paper that contradict the assumption that people accurately take into account payouts and probability when making decisions. More specifically, the professors found general risk aversion in the positive domain and general risk-seeking behavior in the negative domain.

For example, they got greatly different responses to the following questions, one presented in the positive prospect (sure gain) and one in the negative prospect (sure loss).

The researchers asked people whether they would:

- Take a sure $3,000 gain or gamble for an 80% chance of winning $4,000 and a 20% chance of winning $0

- Take a sure -$3,000 loss or gamble for an 80% probability of losing $4,000 and a 20% chance of losing $0

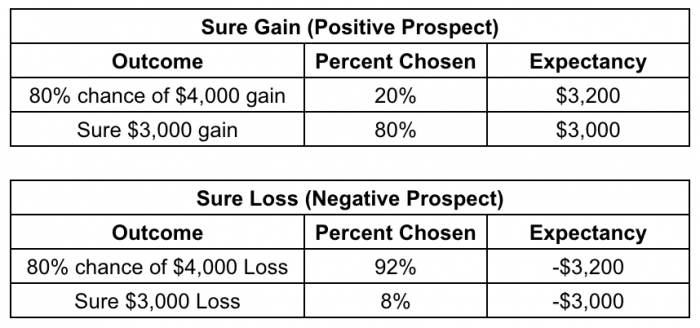

Below is a table summarizing the results:

A couple of things stand out from the table above.

- Notice the large change in answers whether the choice is presented in the positive or negative domains. Specifically, people prefer a sure gain when it is on the table and are willing to gamble to try to avoid a sure loss.

Notice that 80% of the respondents chose the sure gain of $3,000 in the positive domain but only 8% chose to take the sure loss of $3,000 in the negative domain.

Also notice that only 20% of people chose to gamble for more money in the positive prospect but a whopping 92% of people chose to gamble in the negative prospect, as they look to avoid the sure loss.

- Also notice that these results are not consistent with the view that people accurately take into account probabilities when making these kinds of decisions. This is clear in the table above.

I added a column called “expectancy” which does the simple math for each choice. When looking at the math, the “correct” answers are that people should gamble in the positive domain ($4,000 * 80% = $3,200) and take the sure lose in the negative domain (-$3,000 * 100% = -$3,000), as these choices result in a higher expectancy.

The respondents did the exact opposite of what utility-maximizing market participants are supposed to do in this scenario!

This experiment has been re-created numerous times with differing payouts/costs and probabilities. The results have been consistent – that loss aversion is a strong factor in people’s decision making and that they will gamble for the chance to avoid the sure loss. When framed as sure gains vs a gamble for a bigger gain, most people aren’t willing to take the gamble (even if it has a higher expected value) and choose the sure gain.

What Does This Mean To Us As Traders and Investors?

Simply stated, in the real world, people are hard-wired to take their profits much too soon, and to hold their losses much too long. This has large implications for market prices!

Larry Connors