Crude Oil futures prices slip, here’s why

Crude oil futures prices slipped this week as the latest

Department Of Energy (DOE) reports reflected a build in the unleaded inventories

for the first time in nine weeks. This surprised most analysts who were

expecting further drawdowns because of rising demand. However, demand was flat

and imports were way up so the refineries were off the hook this week and

continued to try to complete their seasonal turnarounds in time for the summer

driving season ahead.

The recent pullback for crude oil futures prices is exactly what I’ve been

calling for over the past couple of weeks. Primarily because this market rarely

breaks to new highs and holds for very long before heading lower. Crude oil

needs to gather steam once more before making another the push to the upside and

the recent inventory numbers seem to be the perfect excuse to do just that.

Don’t think for a second that I am discounting the latest and greatest from the

few rogue producers out there that seem to be hell bent on creating panic and

wild speculation in the market place. There is no question that the primary

motivator behind some of the conflicts we are seeing right now from Iran,

Venezuela and Nigeria etc…is greed. That doesn’t mean that these problems aren’t

real and that they can’t have a real effect on crude oil prices if some of these

situations were to escalate further. These countries are producers and that

alone puts them at odds with us as consumers. There is and old saying in the

world of salesmen that says “The best price for me, is the highest price

you’ll pay; the best price for you is the lowest price I’ll sell it for, let’s

meet somewhere in the middleâ€. Right now I think they’re finding out what

their best price is and until demand is notably affected by rising crude oil

futures prices then they will surely go higher.

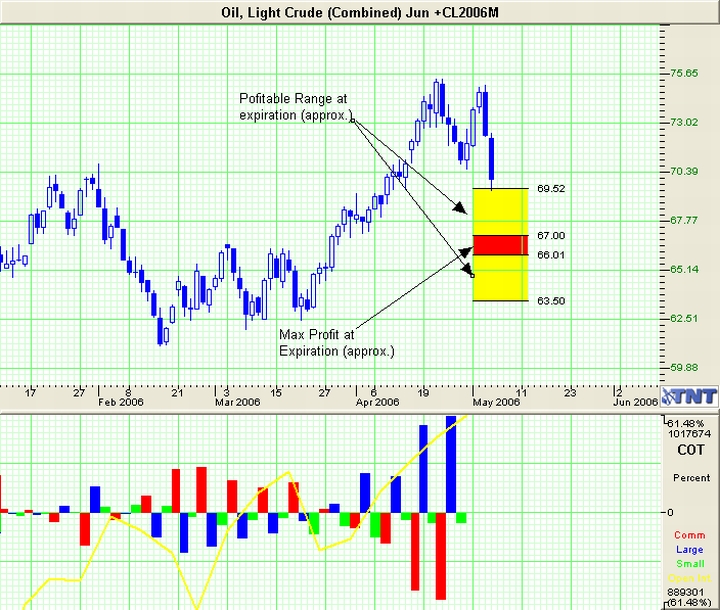

While crude oil futures prices have slipped somewhat over the past week it is

important to note that they are still in a very bullish uptrend and until we see

some fundamentals or technicals that point the other direction I remain a long

term bull with a short term pullback. We are currently holding a bear put ladder

spread in crude that achieves max profits between $67.00 and $66.00. Reference

the chart below.

Matt Odom is Energy Analyst/Principal Broker for Odom &

Frey Futures & Options, LLC. Odom & Frey is widely known as a leader in Option

Spread Strategies on the futures markets and provider of specialized in house

research and commentary. You can find Matt Odom daily throughout the investment

news arena including SmartMoney Futures TV in his "Crude Remarks" segment

where he brings traders into the fold on the latest trading action in the energy

complex. He is also co-author for O&F News & Views, a weekly trading newsletter

read by over 10,000 market enthusiasts each week. You can find this commentary

at www.odomandfrey.com email:

matt@odomandfrey.com phone:

904-247-0232.