Deconstructing Google’s Earnings & 3 PowerRatings Stocks

The anticipation on the face of CNBC’s Maria Bartiromo appeared real as the hotly awaited Google earnings rolled into the newsroom. “Google reports an EPS of $6.06” was the first utterance from the New Jersey based studios.

^GOOG^ shares immediately went into a free fall lower by approximately 24 points. The figure surprisingly missed the consensus estimate of $6.60. “Wait!” one of the talking heads interrupted, “$6.06 is the net income, not EPS!” With this word, shares instantly rocketed higher back to around the pre-close figures.

News of the actual EPS being $6.76, readily beating estimates, was quickly common knowledge within the next minute. Price jumped up and down for the next 25-minutes as the market was digesting the news. You could actually see the orders being filled in both directions as price wildly vacillated.

Then, in-explicitly to many investors, price started dropping again. “How can this be?” moaned my new trader friend who had gone long immediately after CNBC’s initial misspeak was rectified. His profit was quickly a loss as he sat frozen at the trading terminal, afraid to move. “I’ll just ride this out,” he mumbled as what was suppose to be quick scalp turned into an inadvertent swing trade with a fat loss.

What really happened with Google’s earnings? A 38% jump in earnings, beating the Street’s estimates, and climbing income results in a 5% sell off in the stock? Is this a classic buy the rumor, sell the news event? In this case, no matter how positive the news is, it is sold off, as the rumor has already lifted share price to the plateau.

Unspoken expectations for Google to literally blow away all estimates were extremely prevalent among stock traders. This sell the news factor is one part of the Google earnings sell off story. The next, and more tangible reason, is Google’s costs have skyrocketed last quarter.

A hiring campaign lifted costs and expenses to $4.3 billion from $3.6 billion last year. This quarter represented the largest quarterly staff increase in 2 years at the internet giant. Aggressive hiring is expected to continue throughout the rest of the year. Advertising click rate has also grown, which is a positive for the company. Clicks grew by 15% from the same quarter last year.

Is this sell off simply an overreaction to increased costs and a sell the news phenomena? Is there perhaps a deeper unknown, as of yet, reason for the decline?

In trading on Friday, price has rebounded slightly. It is now trading at the 5-minute, 50-period SMA intraday. Time will tell if this is an opportunity of a lifetime to buy into this company or the start of further selling. Every stock trader should watch Google very closely over the next few days!

Regardless of what happens with Google, here are 3 top rated PowerRatings stocks traders need to know.

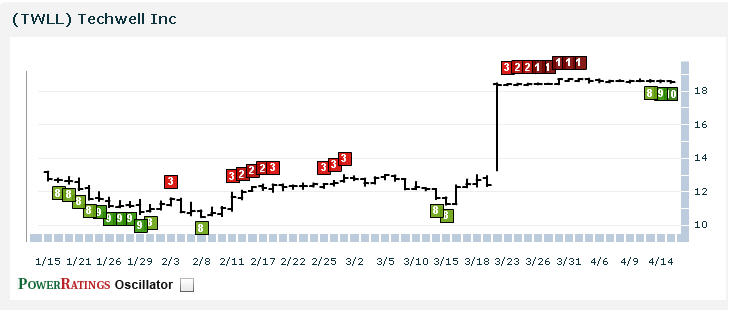

^TWLL^

^ABIO^

^RCNI^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

Backtested on over 17,000 trades test this new trading indicator for Leveraged ETFs and find high probability setups daily – click here now.

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.