Do Stocks That Gap Up Keep Going Up?

What do you get when a weak stock becomes overbought?

The answer, more often than not, is underperformance relative to the average stock.

At least that’s what our research, examining millions of short-term stock trades between 1995 and 2007, tells us. We looked at an incredible number of stocks in an effort to determine what drives short-term stock price movement. And among our conclusions–conclusions that have become the cornerstone of our approach to trading stocks in the short term–was the realization that when weak stocks gap up, then tend not to keep going up.

That one distinction is key. We’re not talking about strong stocks, stocks that are in uptrends, sailing above their 200-day moving averages. Our insight into gaps revolves around weak stocks, stocks that traders are often tempted to chase higher as the stocks suddenly shoot higher as if jolted by an electric current. We found that stocks like these, weak stocks trading below their 200-day moving averages, are not the kind of stocks that short term traders should be betting on. And the fact that those stocks have gapped up by 5%, or 10% or more does not make them any more so.

To read our research into stocks that gap up by 5%, 10% or more, click here.

We found that stocks that had gapped up by 10% or more, as have both stocks in today’s report, while still trading below their 200-day moving averages tended to underperform the average stock in one-day, two-day and one week timeframes. This potentially makes these stocks not just stocks that investors should avoid. It also potentially makes these stocks the kind of stocks that short-term traders can actually profit from wagering against.

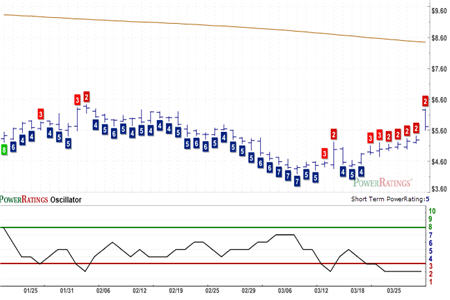

In addition to the PowerRatings charts of both stocks, I have noted the Short Term PowerRatings of both, as well as the 2-period Relative Strength Index values of the two stocks. With Short Term PowerRatings of 2, both of these stocks belong to that category of stock which, according to our research, have underperformed 90% of the stocks in the S&P 500 over the next five days. The 2-period RSIs are noted to show traders just how overbought both of these stocks became as they gapped higher last week.

Centennial Communications

(

CYCL |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 99.82

Tessera Technologies

(

TSRA |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 96.89

Tired of losing money trading breakouts and breakdowns? Our special, Free Report, “5 Secrets to Short Term Stock Trading” will show you some of the key strategies and attitudes that traders throughout history have used to determine the right time to buy and the right time to sell. Click here to get your free copy of “5 Secrets to Short Term Stock Trading”–or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.