Do Stops Hurt Your Trading Performance?

If you’re like most traders, you’ve been taught that you should place a stop on every stock trade you do. And possibly you do. But, is it helping you make money? Or are you constantly getting stopped out only to see the stock rise sharply right after you were stopped out of the position. Frustrating isn’t it?

There may be a good reason why this is happening. It appears (and you may already know this from your trading) that stops hurt, not help your performance. Here’s why.

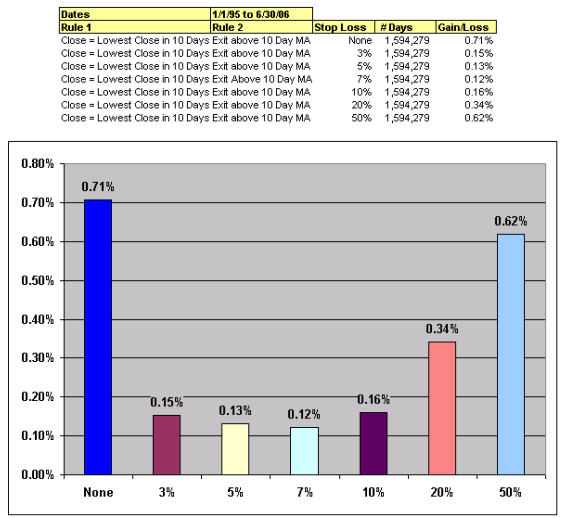

Larry Connors, author of How Markets Really Work and Street Smarts, and editor of the TradingMarkets Daily Battle Plan for Stocks (click here for your free trial), ran a study in which he looked at over 1.5 million trades on stocks that made 10-day lows (pullbacks) and were trending higher, trading above their 200-day moving average. He then tested putting in stops 3%, 5%, 7%, 10%, 20%, and 50% below the entry price.

Did these stops help further improve the performance of these good pullbacks? Absolutely not! In fact they hurt them. Take a look!

Larry looked at every liquid stock that was trading above its 200-day moving average and closed at a 10-day low (a pullback in an uptrend) for more than a decade’s period of time. The exit was above the 10-period moving average. The first test used no stops. The other tests used stops of 3% up to 50%.

As you can see, using stops, no matter where they were placed, hurt the performance of these pullbacks. Interesting the 7% stop, the level most used by traders, performed the worse. The bottom line is no matter where the stop was placed, the performance was lessened by the stops. And it may be why traders get stopped out so often only to see the stock then rise to higher levels.

Here’s one of many thousands of examples of an uptrending stock that got stopped out and then reversed higher.

Chart courtesy of Bloomberg

1. 10-day low pullback above the 200-day after a strong uptrend. 2. & 3. 1% – 7% stops exit long positions. 4. and then a solid resumption of the trend leading to new highs.

What’s the solution? Adjusting your position size, not concentrating too much of your capital in one sector, and knowing where the specialists and market makers are placing their orders all provide opportunities to increase your trading returns.

If you would like to learn more about how to avoid getting stopped out of your positions, and learn how to successfully apply a number of trading strategies that are backed by more than a dozen years of quantified results, please click here to find out more about our Swing Trading College. Past attendees have told us it’s one of the best investment they’ve ever made in themselves for their trading.