Down But Not Out: 3 Oversold Stocks for Traders

The selling that ended last week has resumed in the first few hours of trading on Monday, with the Dow and S&P 500 both down more than 1%.

Stocks were driven into oversold territory on Friday, which means that the current selling is already taking place at exceptional levels. And while it is true that oversold markets can become even more oversold during bear markets, it is also true that the more oversold, the more stretched markets become, the more likely they are to bounce and move in the other direction.

This is all the more the case with stocks that are trading above their 200-day moving averages – as is the case with the three stocks in today’s report. These are the stocks we want to begin looking at when markets begin creating consecutive down days and the widespread selling mood helps drag stocks lower – many of which might be otherwise prepared to move higher.

Here are two specific tools we use to spot not just when stocks are moving lower, but when their movement lower has reached levels that are extreme enough that we can begin to anticipate reversals to the upside in the short term. The first tool or indicator comes into play when stocks above their 200-day moving averages have fallen by 10% or more. Our research indicates that stocks that are trading above their 200-day moving averages and are down by 10% or more over the past five days have actually produced positive returns in one-day, two-day and one-week timeframes.

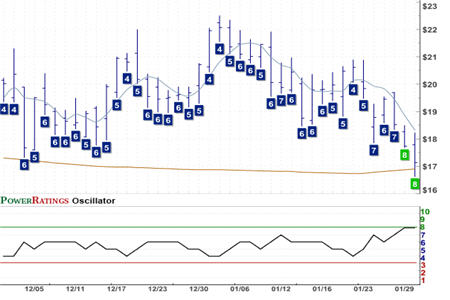

Both The Pantry Inc.

(

PTRY |

Quote |

Chart |

News |

PowerRating), which has a Short Term PowerRating of 8 and a 2-period RSI of 6.50 and Sequenom Inc.

(

SQNM |

Quote |

Chart |

News |

PowerRating), which has a Short Term PowerRating of 9 and a 2-period RSI of 8.44 fall into this category of stocks that have experienced significant pullbacks of 10% or more in recent days. Combined with the high Short Term PowerRatings of the two stocks, the fact that they have recently pulled back so sharply makes them worth watching for potential trades to the upside.

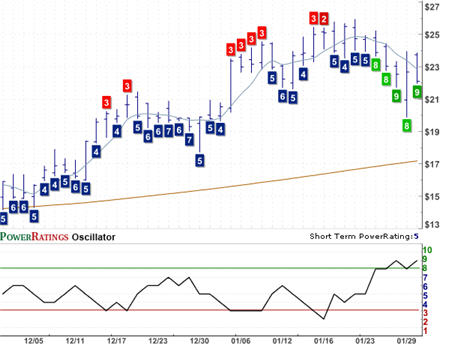

One other indicator that is worth mentioning here is the 2-period RSI, one of our most trusted technical indicators for short term trading. Here, what we are looking for is the lowest possible, 2-period RSI, reflecting the most oversold opportunities, when we are in the market to buy. The biggest edges, however, come from those stocks that have 2-period RSIs of less than 2. Just such a stock appeared in our PowerRatings 25 roster, United Financial Bancorp

(

UBNK |

Quote |

Chart |

News |

PowerRating), which has a Short Term PowerRating of 9, in addition to having a 2-period RSI of 1.69 as of Friday’s close.

Recall that stocks with Short Term PowerRatings of 9 have outperformed the average stock by a margin of more than 13 to 1 after five days. This is based on our quantified backtesting involving of millions of simulated stock trades between 1995 and 2008.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.