Down But Not Out: 3 Stocks for Swing Traders

After an early pop, stocks are holding their modest gains an hour into trading on Thursday.

Three days of selling below the 200-day moving average have helped create significantly oversold conditions in the Dow, S&P 500 and Nasdaq. However, because so many stocks are trading below their 200-day moving averages, this weakness in the broader market has not translated into a surplus of tradable stocks from a swing trading perspective.

Integral Systems Inc.

(

ISYS |

Quote |

Chart |

News |

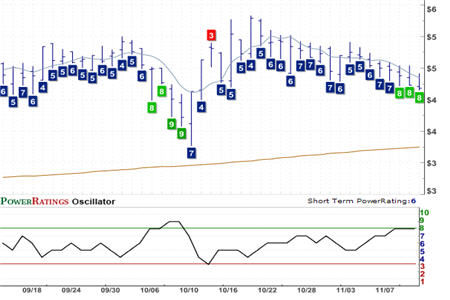

PowerRating) Short Term PowerRating 8. RSI(2): 0.697

There are still a few stocks that are in the tradable category — stocks with Short Term PowerRatings of 8 or higher and 2-period RSIs that are in the single-digits, or even less than one in one instance. These are the stocks that aggressive traders should be focusing on in the current environment, avoiding the temptation of buying stocks that are either already overbought or that are still trading below their 200-day moving averages.

LHC Group

(

LHCG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 2.63

In addition to having low 2-period RSIs and high Short Term PowerRatings, all three of these stocks have been down for five or more consecutive days. That kind of downturn, according to research we have conducted since 1995, tends to lead to positive returns in the near-term, adding to the potential of these oversold stocks to make turnarounds that swing traders may be able to take advantage of. Integral Systems Inc., additionally, has been down by 10% or more over the past five days, marking the stock as all the more oversold.

Unifi Inc.

(

UFI |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 0.881

Lastly, note that all three stocks in today’s report have Short Term PowerRatings of 8. Our research into short term stock price behavior indicates that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.