Down for the Upstroke: 3 Stocks for Swing Traders

The pre-market futures suggested a soft opening Wednesday morning, but in the first hour of trading, stocks are up modestly, with the S&P 500 leading the way.

Opportunities for swing traders in this down market have not been plentiful. And while that fact may rile more aggressive traders, the fact that so few stocks have earned high Short Term PowerRatings of 8 or higher tells us that the good trades simply aren’t there in quantity.

5 Or More Consecutive Lower Lows

Unifi Inc.

(

UFI |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 11.14

This is one of the benefits of using a systematic approach to trading, as opposed to seeing “what looks good” on any given day. As swing traders using Short Term PowerRatings, our first indication of whether or not there are good trades is whether or not we are seeing high Short Term PowerRatings. No high Short Term PowerRatings stocks? No trades for us.

5 Or More Consecutive Down Days

Standex International Corp.

(

SXI |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 1.26

Another approach is to use our TradingMarkets Stock Indicators to see if there are any special situations, such as stocks that have exceptionally low 2-period RSI values, or gaps up or down by more than 10%. Our research into short term stock price behavior indicates that many of these special situations, situations that look bearish to the uninformed observer, actually result in positive returns in one-day and one-week time frames.

To learn more about our TradingMarkets Stock Indicators, click here.

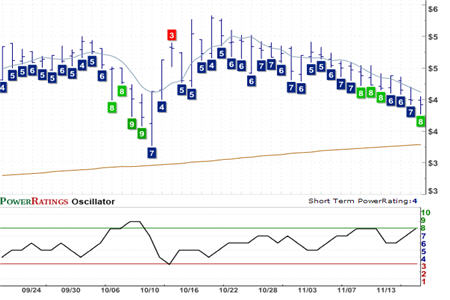

I have included throughout PowerRatings charts of three stocks from our TradingMarkets Stock Indicators page that I thought were worth mentioning this morning. Each stock selection was the product of a different indicator – from consecutive lows to declines above the 200-day moving average of 10% or more. In a market with so few opportunities for swing trades to the long side, these three stocks may be worth a look.

10% Or More Down in Five Days

Bank of the Ozarks

(

OZRK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 6.34

Back by popular demand, our momentum trading strategy, the 5x5x5 Portfolio Method, has had an average compound annual return of 118.79% for more than 7 years, with 71% profitable trades since 2001.Click here to find out more about the 5x5x5 Portfolio Method Today!

David Penn is Editor in Chief at TradingMarkets.com.