Drop the Stops & 3 Bearish PowerRatings Stocks

“Drop the stops?? Are you out of your mind?!” I can hear most of you saying this after reading the title. But this article might just surprise you.

Stops are an integral part of most stock trader’s arsenal. Many consider it foolhardy and naive to trade without a fixed stop in place prior to entering a position. As with most of the conventional market wisdom, these feelings do not hold up to vigorous testing.

We have run 100’s of tests have that have proven fixed stops actually hurt the performance of any trading system. One example took all shares trading above their 200-day Simple Moving Average closing at its 10-day low. The trade would be exited on a close above its 10-day Simple Moving Average or when a stop is hit at a variety of percentage points below the entry.

Out of nearly 400,000 tested trades, stops hurt the performance of the system. In fact, the tighter the stop, the worse the performance. Even stops as wide as 50% away from the entry dampened the systems returns. Of course there are psychological benefits to using fixed stops but at the expense of profit. Dropping the fixed stops is a sure way to improve the results of your trading system.

Before one exits a trade with any kind of methodology, the trade needs to be entered first. If you are looking to short overbought stocks for the short term, here is a simple 3 step plan to find shares ready to drop.

Remember, these same principles work whether or not an overall market drop occurs or not. In other words, they are stock, not market specific.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

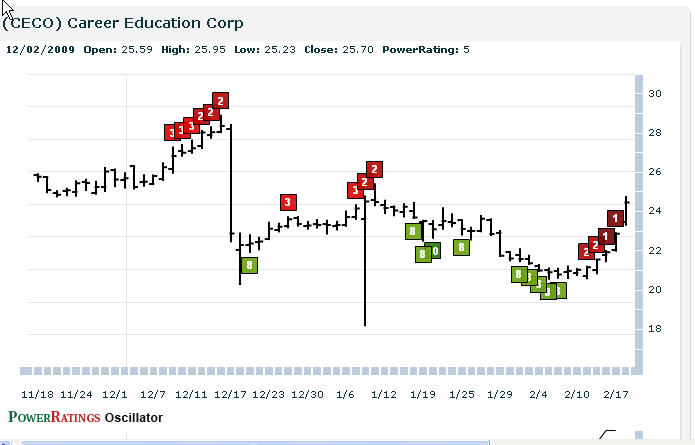

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

^CECO^

^NEU^

^MINI^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.