Emini Futures Outlook

Emini Futures Outlook

Austin Passamonte

Great Morning!

After the Thanksgiving holiday weekend, there were no x-mas

shoppers to be found in the aisles on Wall Street. It seemed more

like Boxing Day instead, where returns and refunds ruled the U.S. stock market

session.

S&P 500 opened the pit session on a strong sell

signal near 1401, and then gave a secondary sell signal near 1397 when S2 value

was broken soon after. Either of those short signals worked stellar, as the

index finally painted a chart with greater range than 7pts wide between the

bells.

There were other sell signals further down the

scale, as one would expect in a directional day like this. At no time should any

ES trader have been a buyer, just short or flat all day.

Chart 1: ES (+$50 per index point)

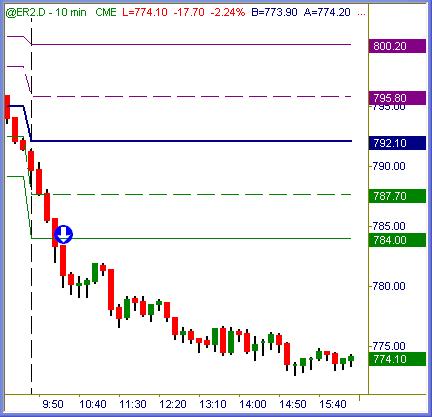

Chart 2: ER

(+$100 per index point)

Russell 2000 futures mirrored the ES, which

always means favorable trading conditions. When one symbol is heading upwards

while the other treads down, sideways congestion (as we’ve endured for a couple

of weeks now) is the result. When both symbols rise or fall in unison, it means

broad-based accumulation – distribution is underway.

ER gave sell signals at 790, 783.50 and 779+ all

before noon est. While no trading day is ever easy, this one was simple as it

gets.

Chart 3: ES (+$50 per index point)

S&P 500 futures have returned right back to where

they were fifteen sessions ago. In other words, the prior three weeks of dead

volume, micro-range session advance was completely erased in 6.5 market hours.

This is how the tired, extended rally has advanced all year. Lots of creeper

type up days negated by one slam move lower before the process repeats itself.

Note how the ES halted nearly to the tick on key

support of the most recent upswing. Clusters of buy stops and sell stops exist

near 1382, a congestive point since mid-October. This one needs to hold support

right here for continuation higher. A close below 1380 seeks out 1372 and then

1350 from there.

Chart 4: ER

(+$100 per index point)

Russell 2000 futures paused at the halfway mark

of November’s upward progress. 62% and the 50dma both await retests below to see

where buyers may take a stand. Similar chart to the S&P above, but comparatively

stronger.

Summation

No one with any sense of normal market action was surprised by the one-day

pullback here. With Bernanke speaking midday and Greenspan in public later,

markets will hang on their every word for hints of rate decisions pending. This

morning is likely to follow yesterday’s trend, followed by reaction to

Bernanke’s utterance either way. A moderate slate of economic reports this week

gives traders plenty of fodder to jerk the tapes in volatile fashion.

End-month sessions have an upside bias, and

year-end props to the market should keep price action higher into the last

session of 2006, but factors unknown to the markets right now always have

potential to derail that ride. No change in the outlook for now… sideways to

higher market action is fundamentally probable unless otherwise thwarted by

factors unseen right now. The latest dip will bring in dipsters looking for the

next key long trade entries right here. How they fare with that this week may

set the tone for December.

Trade To Win

Austin P

[Online

video clip tutorials…

open access]