ETF Daily Analysis for High Probability Traders: Overbought Oil ETFs

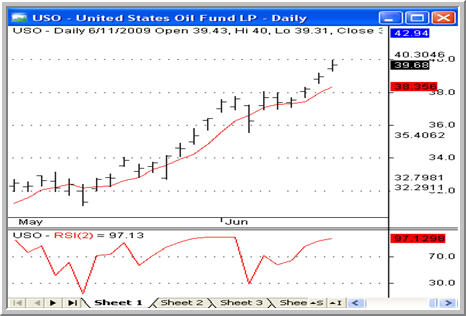

Across the landscape of exchange-traded funds (ETFs) some of the more interesting moves are taking place among the commodity-based ETFs of the oil patch. A number of these ETFs, in concert with the rising price of crude oil, have been advancing dramatically in recent days, becoming increasingly overbought below the 200-day moving average.

These ETFs include the United States Oil Fund

(

USO |

Quote |

Chart |

News |

PowerRating) which tracks the actual price of oil …

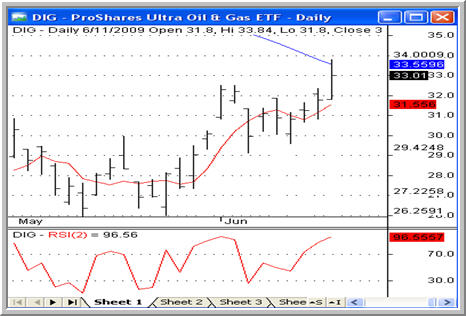

… as well as ETFs like the ProShares Ultra Oil & Gas ETF

(

DIG |

Quote |

Chart |

News |

PowerRating), which tracks the share prices of oil companies in the Dow Jones U.S. Oil & Gas index.

What kinds of opportunities do these overbought oil ETFs present?

When it comes to high probability ETF trading, our research has indicated that some ETFs tend to revert to the mean better than others. And because high probability ETF trading is also mean reversion trading, we want to be focusing on those ETFs that are most likely to move back and forth between overbought and oversold conditions.

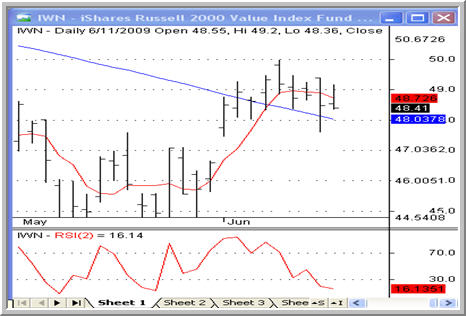

Top of this list are equity and country ETFs. Funds that track an index like the S&P 500 or follow the national stock market of a country like Taiwan have performed best in our historical testing, moving more consistently back and forth between overbought and oversold conditions over time. When we are looking for ETFs to trade, equity index and country ETFs are where we start. An example of an oversold equity index is the iShares Russell 2000 Index ETF

(

IWN |

Quote |

Chart |

News |

PowerRating).

Second in line are sector funds – particularly those that are not commodity based such as financials or in technology. Sector ETFs have been preferable to commodity ETFs in our historical testing. Again, the key ingredient is the tendency to revert to the mean. With sector ETFs that tendency may not be as pronounced as with equity index and country ETFs, but it is stronger than the ones we find in commodity-based ETFs.

Does this mean that high probability traders should avoid trading these overbought ETFs? Not necessarily. But for traders who are focused on trading where the biggest edges lie, avoiding commodity ETFs and waiting for set-ups to appear among the equity index, country or sector ETFs may prove to be a more prudent approach to high probability ETF trading.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to pre-order High Probability ETF Trading,the first quantified book of trading strategies to improve your ETF trading.

David Penn is Editor in Chief at TradingMarkets.com.