ETF Software and RSI 25/75: High Probability Entries, High Probability Exits

What do the SPDR S&P Homebuilders ETF

(

XHB |

Quote |

Chart |

News |

PowerRating), the SPDR Dow Jones REIT ETF

(

RWR |

Quote |

Chart |

News |

PowerRating) and the iShares Cohen and Steers Realty Majors ETF

(

ICF |

Quote |

Chart |

News |

PowerRating) have in common?

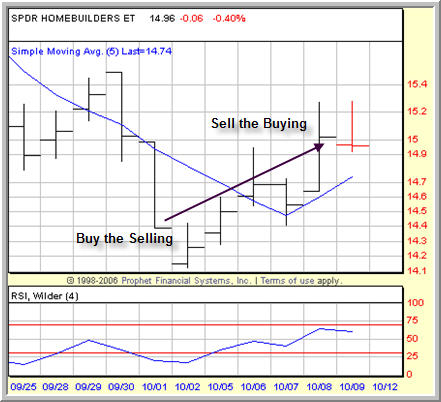

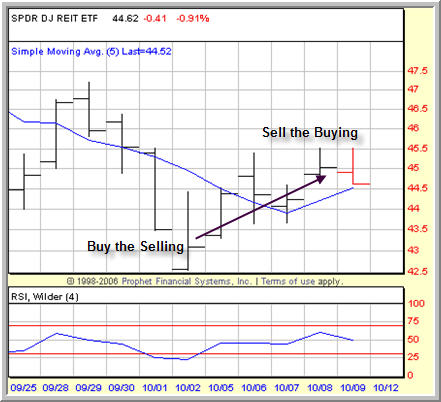

In addition to being exchange-traded funds (ETFs) related to the home building and real estate sectors, all three of these ETFs were part of more than 10 profitable exits on Thursday for high probability traders following the RSI25/75 strategy — one of seven strategies available to traders by way of TradingMarkets High Probability ETF Software.

Click here to start your free, 7-day trial to TradingMarkets High Probability ETF Software!

The financial media was a buzz on Thursday with news that the House of Representatives was considering an extension of the first-time home buyers’ tax credit. But while a number of traders — including at least one CNBC commentator — puzzled over whether or not the news from Congress was a buy signal, traders who know and appreciate what high probability trading is all about were long days before the announcement. This enabled high probability traders to sell into the bullishness of the news, rather than trying to chase markets higher after the fact.

The three ETFs mentioned above earned gains of 4.4%, 4.5% and 3.5% and were among the most profitable trades from a set of high probability ETF trading signals issued on or near the beginning of October based on a high probability ETF trading strategy called RSI 25/75. This high probability trading strategy was first developed in 2003 as a long-only ETF trading strategy and has since been upgraded to include the short strategy (the RSI 75 part of the RSI 25/75 strategy).

What is the hallmark of the RSI 25/75 strategy? Like all of our high probability ETF trading strategies, RSI 25/75 is based on buying ETFs after they have pulled back above their 200-day moving averages, and selling them into strength as they recover. The strategy has a historic win rate of more than 76% to the long side in our testing — a win rate that jumps to more than 82% when aggressive versions using scale-in strategies are considered.

The RSI 25/75 strategy is one of the oldest ETF trading strategies devised by Larry Connors (founder of TradingMarkets and author of the book, High Probability ETF Trading) and the team at Connors Research. Originally developed for use with major equity index ETFs like the SPDR S&P 500 ETF

(

SPY |

Quote |

Chart |

News |

PowerRating) and the PowerShares QQQ Trust ETF

(

QQQQ |

Quote |

Chart |

News |

PowerRating), it is a testament to the robustness of the high probability, mean reversion approach to short-term trading that this strategy continues to provide excellent trading signals – and in an even wider variety of ETFs, from sector ETFs to country funds.

With markets becoming more and more overbought in the first half of October, the next pullback could be only days away. And there may be no easier way for ETF traders to prepare themselves for the next round of trading signals than with our High Probability ETF Trading Software. Click here to start your free trial and find out for yourself what high probability trading can do for you.

David Penn is Editor in Chief at TradingMarkets.com.